The crypto market faces renewed volatility and uncertainty following the current Bitcoin price crash under the $100,000 mark. Consequently, a crypto analyst has shared a reasonably prolonged X (previously Twitter) submit outlining what to anticipate following this vital decline. He warns of important ranges to observe as selling pressures intensify, noting that each macro and technical indicators paint a combined image of Bitcoin’s short-term worth trajectory.

Key Ranges To Watch After The Bitcoin Worth Crash

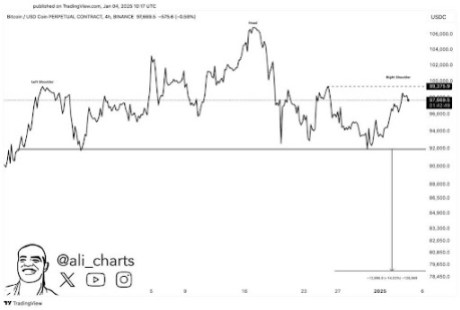

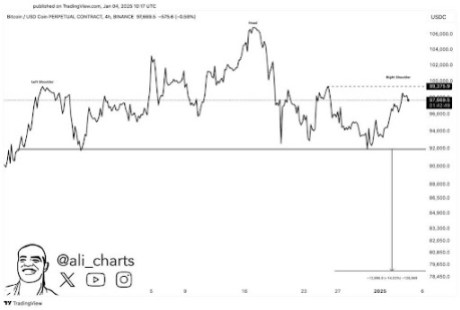

In line with outstanding crypto analyst Ali Martinez, the Bitcoin worth is as soon as once more buying and selling under $100,000 after surpassing this milestone earlier this week. Martinez revealed that in the day before today, Bitcoin breached the suitable shoulder of a Head and Shoulder pattern, fully invalidating its bearish setup on the time. Nevertheless, in simply 24 hours, the cryptocurrency erased these vital features, pushing its worth again under the suitable shoulder of the technical sample and reigniting bearish sentiment.

Associated Studying

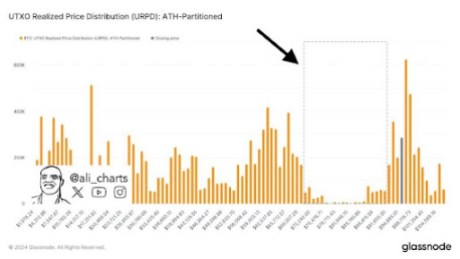

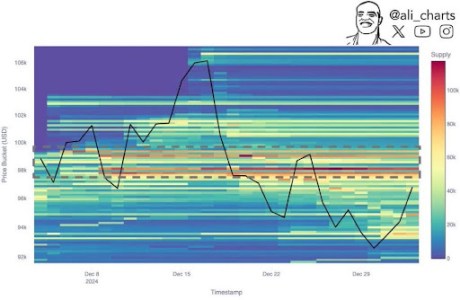

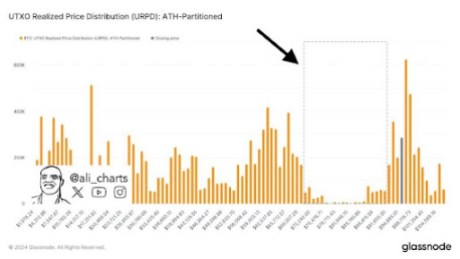

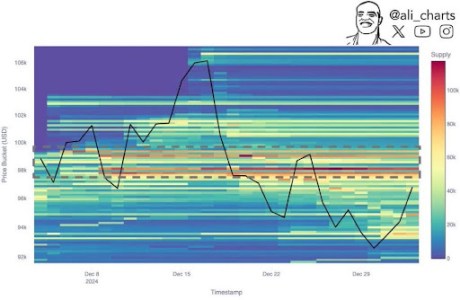

With its huge crash below $100,000, Bitcoin has now plummeted considerably under the important thing demand zone between $95,000 and $98,000, an space the place roughly 1.77 million wallet addresses had bought greater than 1.53 million BTC, price over 141.3 billion at the moment market charge.

Whereas many traders sometimes purchase and maintain BTC for revenue, the current Bitcoin worth crash has raised issues that house owners of the 1.77 million pockets addresses could also be compelled to sell off their holdings to chop down potential losses. Martinez warns that rising promoting pressures may push the Bitcoin worth under $92,000, doubtlessly triggering a good sharper and extra fast decline, with restricted help till it reaches the $74,000 mark. Notably, the analyst labels a drop under $92,000 a “free fall territory,” which means Bitcoin may proceed to crash as panic selling intensifies and liquidity dries up.

Including to the continuing uncertainty, Bitcoin’s reversal under the suitable shoulder of the Head and Shoulders sample, mixed with present bearish market circumstances, has reignited fears, leaving many traders bracing for a deeper price crash.

Rebound On The Horizon Or Extra Ache Forward?

Regardless of Bitcoin’s present bearish outlook, Martinez reassures crypto group members {that a} worth rebound is feasible. The analyst disclosed that Bitcoin’s TD sequential indicator lately flashed a purchase sign on the 4-hour chart, suggesting {that a} potential price recovery and rebound could also be underway.

Associated Studying

Apparently, Binance traders stay bullish on Bitcoin, with this optimistic sentiment pointing to a short-term restoration towards $98,600, a worth stage with a $35 million liquidation zone that market makers covet. Martinez highlights {that a} sustained break above the $100,000 mark is important to invalidating Bitcoin’s present bearish outlook and setting the stage for new all-time highs.

Nevertheless, if Bitcoin fails to reclaim this psychological stage and falls under $92,000, it dangers additional draw back, doubtlessly correcting towards new vary lows between $78,000 and $74,000. As of writing, the Bitcoin worth is buying and selling at $94,154, which means a drop in these vary lows would mark a large 17.16% to 21.41% decline.

Featured picture created with Dall.E, chart from Tradingview.com

The crypto market faces renewed volatility and uncertainty following the current Bitcoin price crash under the $100,000 mark. Consequently, a crypto analyst has shared a reasonably prolonged X (previously Twitter) submit outlining what to anticipate following this vital decline. He warns of important ranges to observe as selling pressures intensify, noting that each macro and technical indicators paint a combined image of Bitcoin’s short-term worth trajectory.

Key Ranges To Watch After The Bitcoin Worth Crash

In line with outstanding crypto analyst Ali Martinez, the Bitcoin worth is as soon as once more buying and selling under $100,000 after surpassing this milestone earlier this week. Martinez revealed that in the day before today, Bitcoin breached the suitable shoulder of a Head and Shoulder pattern, fully invalidating its bearish setup on the time. Nevertheless, in simply 24 hours, the cryptocurrency erased these vital features, pushing its worth again under the suitable shoulder of the technical sample and reigniting bearish sentiment.

Associated Studying

With its huge crash below $100,000, Bitcoin has now plummeted considerably under the important thing demand zone between $95,000 and $98,000, an space the place roughly 1.77 million wallet addresses had bought greater than 1.53 million BTC, price over 141.3 billion at the moment market charge.

Whereas many traders sometimes purchase and maintain BTC for revenue, the current Bitcoin worth crash has raised issues that house owners of the 1.77 million pockets addresses could also be compelled to sell off their holdings to chop down potential losses. Martinez warns that rising promoting pressures may push the Bitcoin worth under $92,000, doubtlessly triggering a good sharper and extra fast decline, with restricted help till it reaches the $74,000 mark. Notably, the analyst labels a drop under $92,000 a “free fall territory,” which means Bitcoin may proceed to crash as panic selling intensifies and liquidity dries up.

Including to the continuing uncertainty, Bitcoin’s reversal under the suitable shoulder of the Head and Shoulders sample, mixed with present bearish market circumstances, has reignited fears, leaving many traders bracing for a deeper price crash.

Rebound On The Horizon Or Extra Ache Forward?

Regardless of Bitcoin’s present bearish outlook, Martinez reassures crypto group members {that a} worth rebound is feasible. The analyst disclosed that Bitcoin’s TD sequential indicator lately flashed a purchase sign on the 4-hour chart, suggesting {that a} potential price recovery and rebound could also be underway.

Associated Studying

Apparently, Binance traders stay bullish on Bitcoin, with this optimistic sentiment pointing to a short-term restoration towards $98,600, a worth stage with a $35 million liquidation zone that market makers covet. Martinez highlights {that a} sustained break above the $100,000 mark is important to invalidating Bitcoin’s present bearish outlook and setting the stage for new all-time highs.

Nevertheless, if Bitcoin fails to reclaim this psychological stage and falls under $92,000, it dangers additional draw back, doubtlessly correcting towards new vary lows between $78,000 and $74,000. As of writing, the Bitcoin worth is buying and selling at $94,154, which means a drop in these vary lows would mark a large 17.16% to 21.41% decline.

Featured picture created with Dall.E, chart from Tradingview.com