- HYPE is at present buying and selling inside a descending channel, with the potential to fall additional relying on the way it reacts at its present degree.

- Key indicators and Complete Worth Locked (TVL) stay bearish. Nonetheless, the RSI is progressively hinting that promote strain could also be easing.

Hyperliquid [HYPE] ranks among the many high losers out there, dipping 16.57%, over the previous 24 hours. This decline has decreased its month-to-month good points to 64.93%.

The token’s motion at its present value degree will decide whether or not it levels a big rally or faces additional losses as market sentiment weakens.

Will HYPE yield positively from this sample?

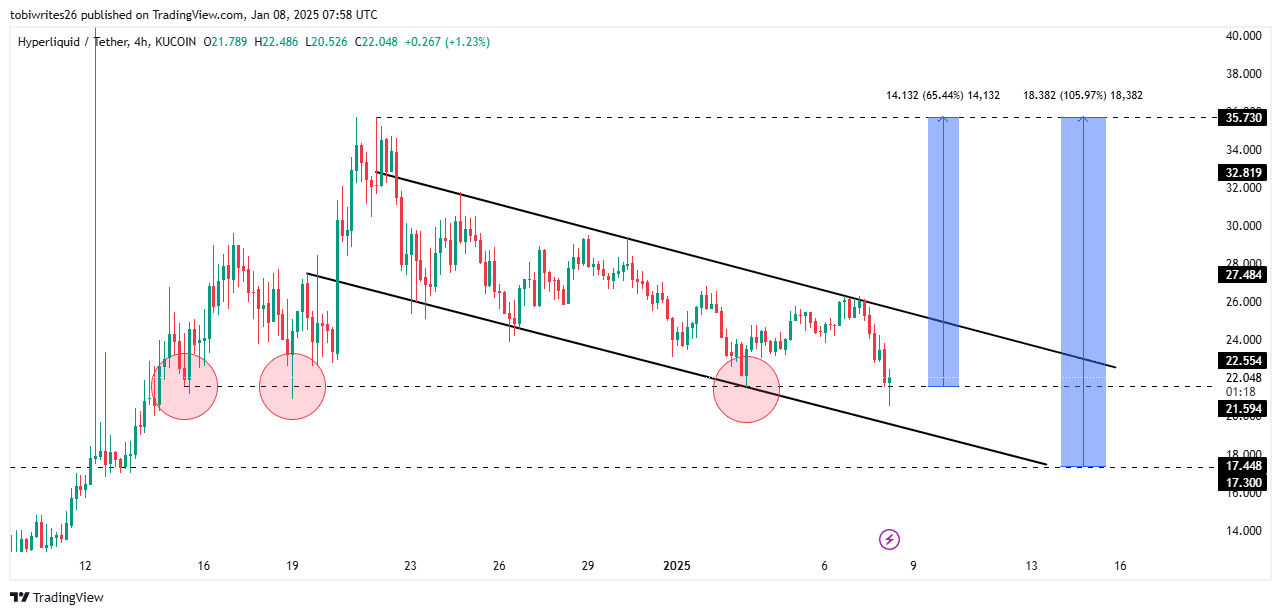

Technical evaluation of HYPE’s 4-hour chart reveals that the asset is buying and selling inside a descending channel, characterised by decrease highs and decrease lows. Buyers proceed to build up in anticipation of an upward transfer.

A bullish breakout from this sample happens when the value breaches the higher resistance line of the channel, doubtlessly reaching its peak of $35.7.

On the time of writing, HYPE is buying and selling inside a assist zone at $21.59, which has beforehand acted as a bullish catalyst on three events. If this assist gives the required momentum, HYPE may rebound and achieve 65.44%, reaching the talked about peak.

Nonetheless, if the $21.59 assist degree is breached, HYPE may drop to the following assist at $17.30. This degree could act as a catalyst for a remaining push upward, doubtlessly leading to a 105.97% achieve.

Combined market alerts

At present, an evaluation of technical indicators reveals blended market sentiment, mirrored in dealer exercise close to the assist degree.

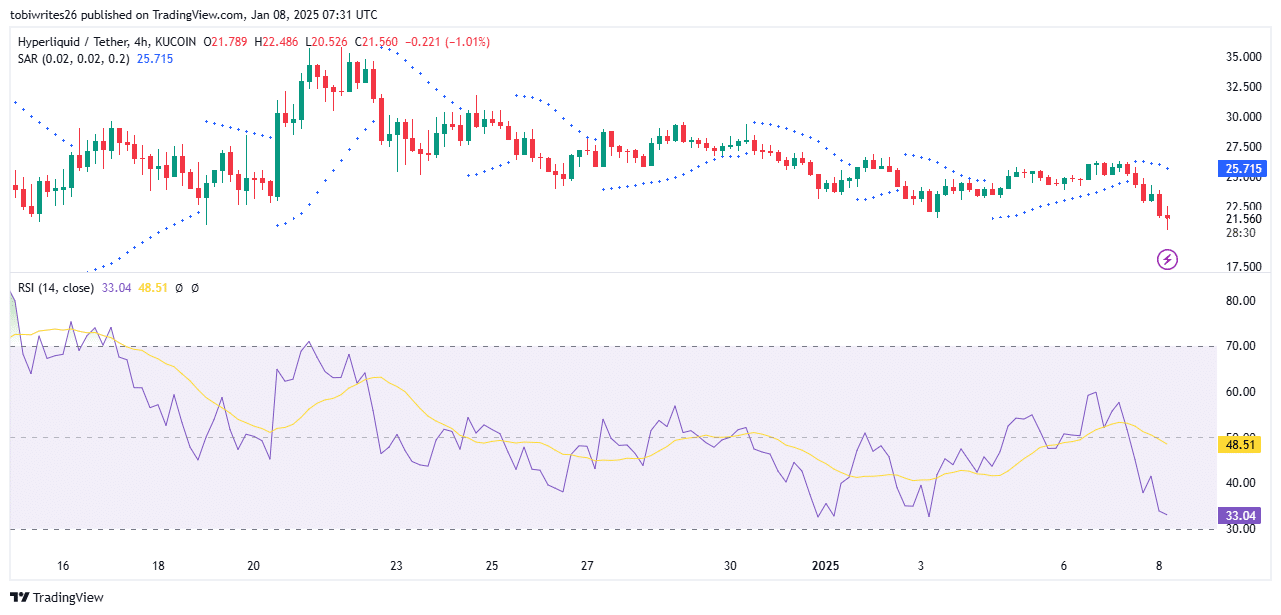

The Parabolic SAR (Cease and Reverse), which identifies development instructions and reversals by dots positioned above or beneath value actions, at present exhibits dots above HYPE.

Dots above the value recommend a bearish market sentiment for HYPE, indicating that it may decline farther from its present zone.

In the meantime, the Relative Power Index (RSI), one other technical indicator, measures the velocity and magnitude of value modifications to determine overbought or oversold circumstances.

On the time of writing, the RSI stood at 33.04, indicating growing promoting strain because it approaches the oversold area. The RSI was heading towards the oversold area (beneath 30), suggesting that promoting strain could ease at that degree.

If HYPE drops beneath the 30 mark, it may bounce again and start a restoration. Nonetheless, HYPE may reverse its development from the present degree with out falling beneath 30.

Liquidity outflow hits HYPE

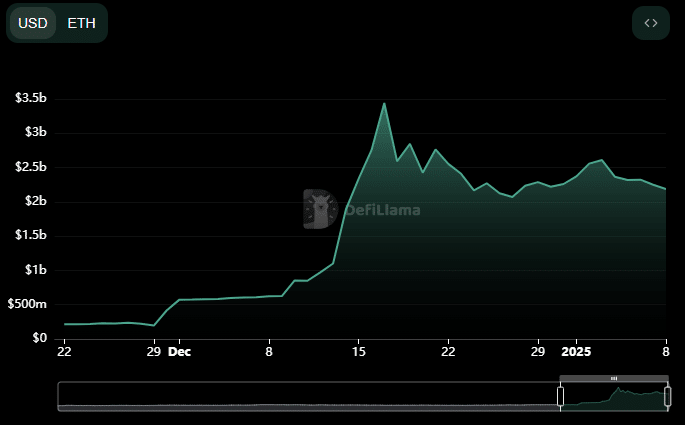

HYPE has skilled important liquidity outflows, with its TVL dropping to $1.553 billion, a degree final seen on December 14. This follows a peak of $2.244 billion on the 2nd of January.

Learn Hyperliquid’s [HYPE] Price Prediction 2025–2026

Liquidity outflows in TVL point out declining curiosity, which regularly negatively impacts HYPE’s value and will result in additional declines.

If liquidity outflows persist, HYPE may proceed to say no from its present degree, doubtlessly falling to even decrease ranges.