- Bitcoin dominance is a vital gauge of the place buyers are funneling their cash.

- The emergence of a dying cross after 4 years isn’t only a technical sign – it’s a transparent warning.

Regardless of Bitcoin [BTC] ending the primary week of 2025 on a excessive, reclaiming $102K after two weeks of market downturn, its dominance has taken a small dip.

This might sign that altcoins are beginning to seize the highlight, as buyers eagerly rush to diversify.

So, is a repeat of the 2021 cycle on the charts?

Usually, when Bitcoin dominance slips, it’s usually a robust signal that an altcoin season is about to kick off. And proper now, that speculation is gaining weight.

Over the previous week, the market has turned inexperienced, with high-cap altcoins posting double-digit positive factors. Whereas it’s nonetheless early to make daring predictions, the indicators are there, and it’s a pattern that’s undoubtedly one to look at.

Why? 4 years in the past, Bitcoin began Q1 with its dominance at 72%, however in lower than 4 months, that fell under 40%, simply as a dying cross appeared on Bitcoin’s dominance chart.

In response, Ethereum [ETH] skyrocketed from $737 in January to $4,183 by Could, a large 467% bounce. And get this: that’s 4 occasions the 107% bounce Bitcoin made in the identical interval.

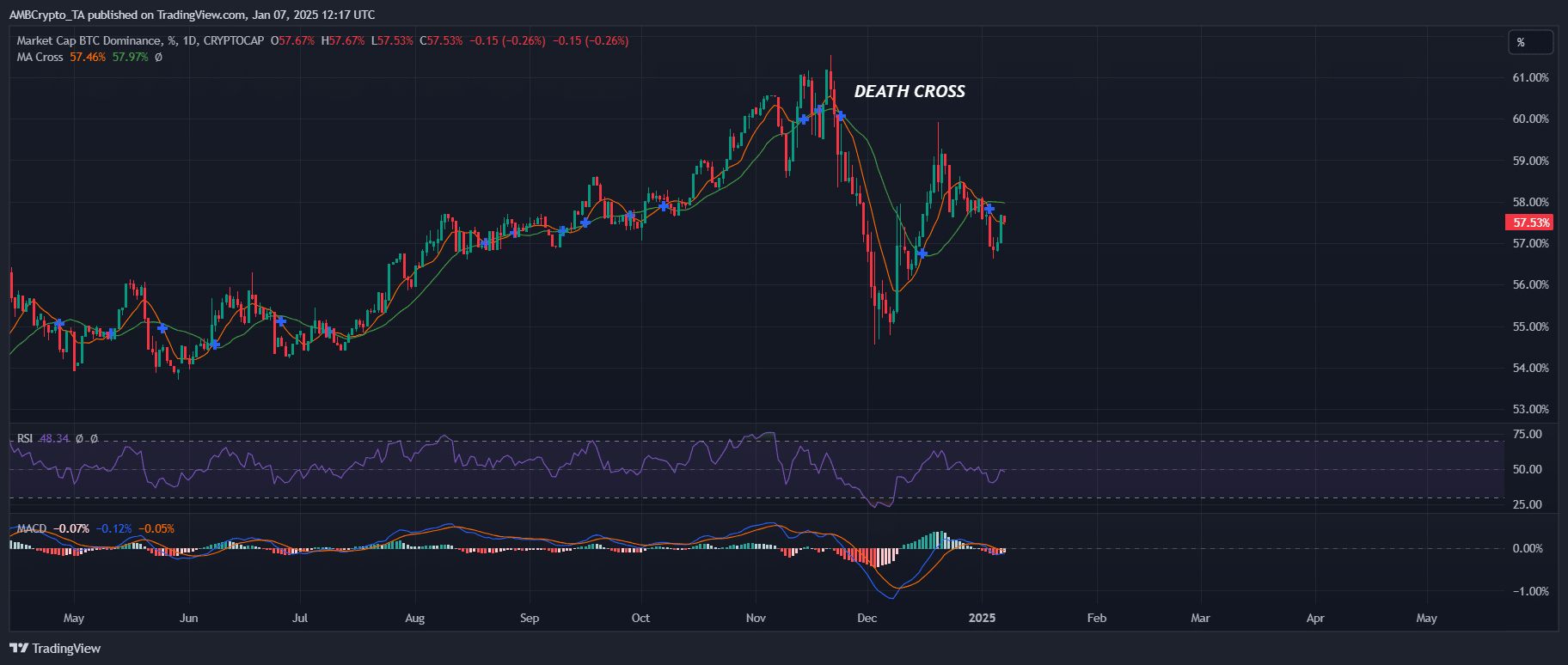

So, is historical past repeating itself? The market appears to be hinting at it. In mid-November, a dying cross shaped on Bitcoin’s dominance chart for the primary time in 4 years.

The consequence? BTC’s market share slipped from 60% to 54% in simply two weeks. Throughout that very same time, Ethereum surged 30%, closing above $4K.

However a lot has modified up to now 4 years. Whereas a dying cross usually alerts an altcoin rally, it doesn’t routinely imply Ethereum will lead the cost.

The crypto panorama has advanced, and contemporary contenders may rise to take the highlight.

So, who may take the lead as Bitcoin dominance slips?

Apparently, memecoins are making a robust splash, dominating the top gainers’ list with weekly surges of over 50%. The truth is, three out of the highest 5 tokens are meme-based, proving that the meme mania is on an increase.

Nonetheless, this pattern additionally highlights that buyers are attempting to find quick, short-term positive factors, particularly with Bitcoin breaking the $100K barrier. It’s clear – memecoins are following the lead.

What’s much more fascinating is how meme-based tokens are outperforming conventional altcoins proper now. Take DOGE/BTC, for instance – on the point of a breakout with the MACD turning bullish.

Learn Dogecoin’s [DOGE] Price Prediction 2025–2026

The takeaway? Buyers appear extra within the “hype” than the long-term “worth,” making the memecoin market one to look at intently.

As Bitcoin dominance faces growing stress from these looking for cheaper, much less risky options, the highlight on memecoins may develop even brighter.