- ETH has turned inexperienced on each day and weekly charts, climbing by 1.67% and 1.74% respectively.

- Ethereum’s Futures signaled a possible restoration as promoting stress eased.

Ethereum [ETH] has struggled to keep up an upward momentum over the previous two weeks. Over this era, the altcoin has traded inside a consolidation vary of between $3500 and $3300.

These prevailing market situations have left key stakeholders questioning what might increase ETH in direction of restoration.

Inasmuch, CryptoQuant analyst Burak Kesmeci has identified 4 key Futures market metrics and what they counsel about Ethereum’s trajectory.

Futures markets assess Ethereum

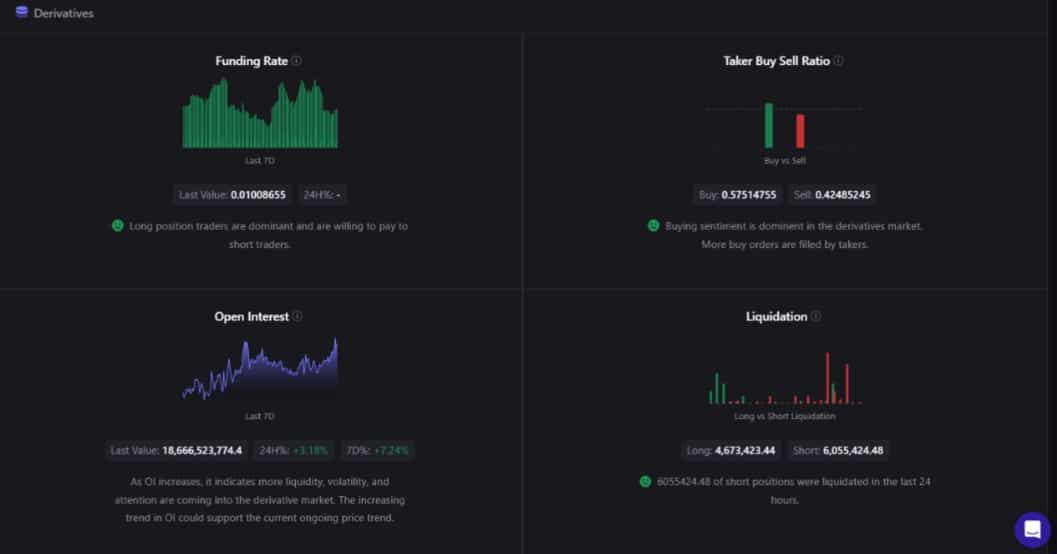

In his evaluation, Kesmeci cited 4 essential Futures market metrics together with Funding Charge, Taker Purchase-Promote Ratio, Open Curiosity, and liquidation.

Ethereum’s Funding Charge was at 0.01 at press time, which recommended that the market was wholesome, with longs in a position to help ETH’s spot market.

Secondly, Ethereum’s Taker Purchase Promote ratio was at 0.57, suggesting that purchasing sentiment was dominating the derivatives market.

When consumers are lively, it causes a better shopping for stress, which is essential for larger costs by demand.

Moreover, Ethereum’s Open Curiosity has surged by 3.18% in 24 hours, signaling a slight heating up within the derivatives, though for a brief time period.

Lastly, Ethereum’s liquidation confirmed {that a} appreciable quantity of brief positions had been being actively liquidated, with $6 million over the previous day till press time.

This reduces promoting stress in derivatives markets, thus undoing the influence of rising Open curiosity.

Thus, promoting stress in ETH Futures markets had eased significantly. However though Open Curiosity could present the market is seeing heating, the bulls had entered the market and seemed to be stepping up.

May Futures increase ETH towards restoration?

Whereas Ethereum’s efficiency on the derivatives markets supplied a promising outlook, it’s important to counter-check what efficiency on the spot market says.

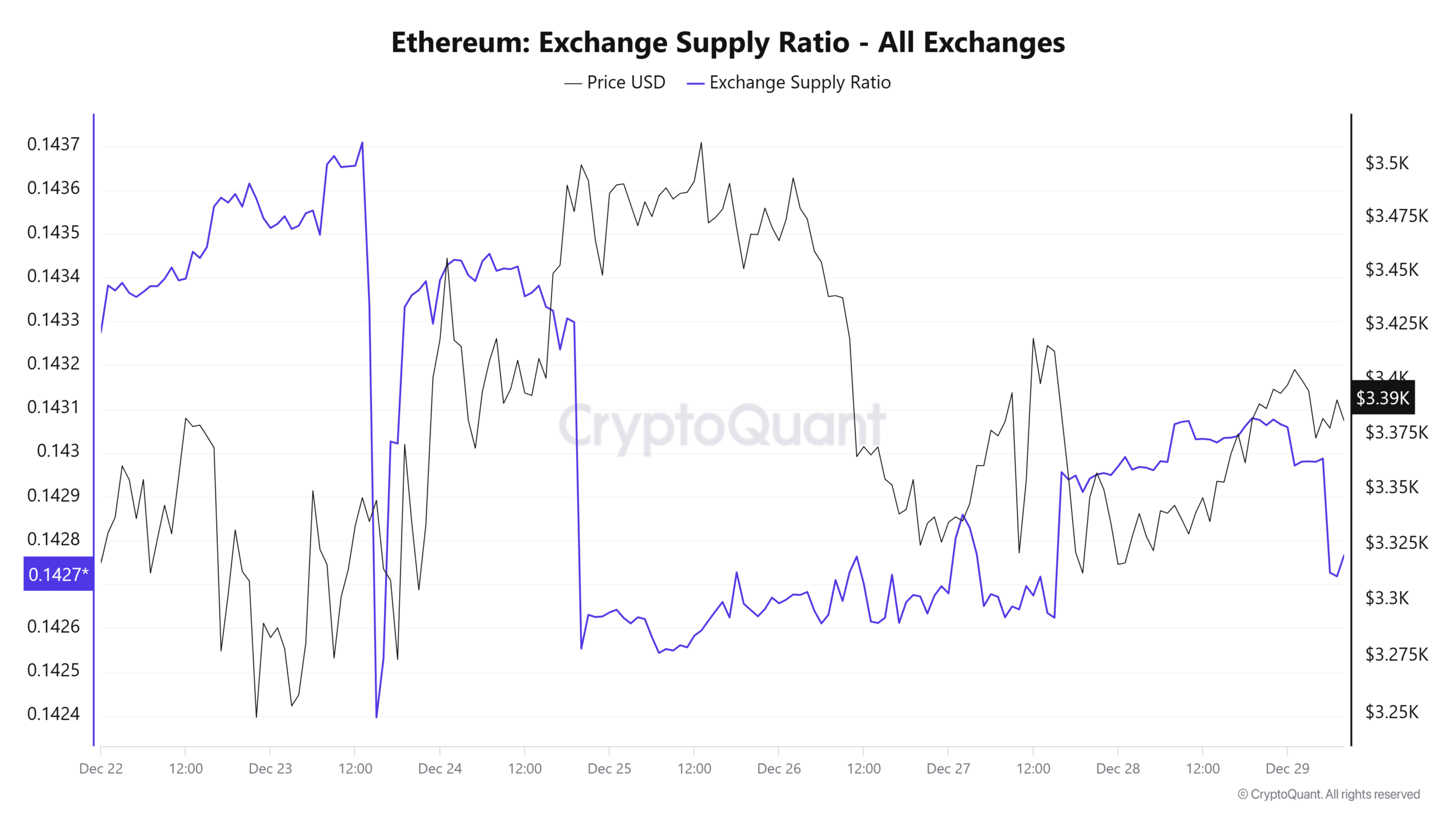

For starters, whereas the Alternate provide ratio isn’t unique to identify markets, provide on exchanges correlates to identify market exercise.

As such, ETH’s alternate provide ratio has diminished over the previous week to 0.14 at press time. Such a decline means that buyers are holding their property off exchanges.

This market habits displays accumulation and hoarding in anticipation of higher costs.

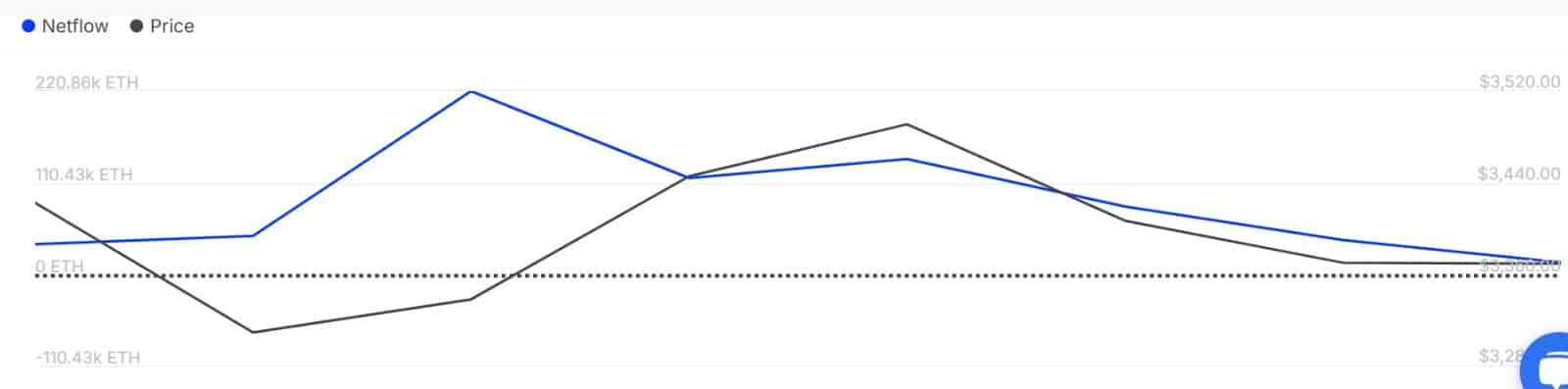

This optimistic sentiment has additionally been prevalent amongst giant holders over the previous week. As such, the big holder’s netflow has remained optimistic all through the week.

This indicated extra capital influx from whales.

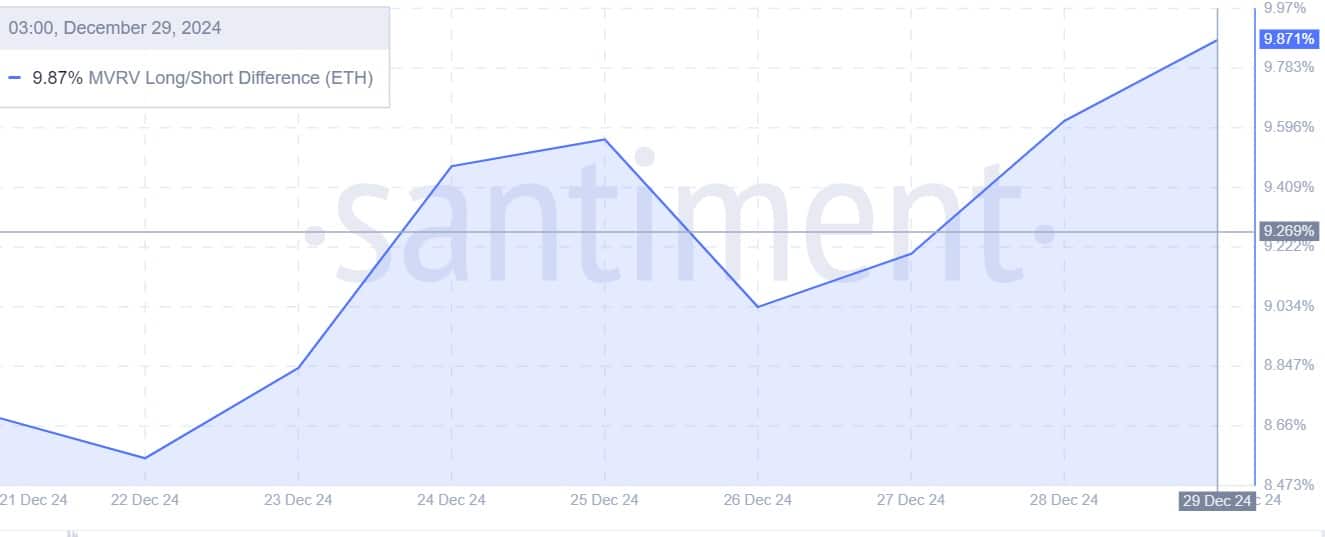

Lastly, amidst accumulation, ETH long-term holders have turned bullish and had been assured of the altcoin’s prospects, as their revenue margins outweighed short-term holders.

In conclusion, bulls had been stepping up in derivatives and throughout spot market exercise. When investor confidence rises throughout these two, Ethereum might see a major restoration on its worth charts.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

With optimistic sentiments rising available in the market, ETH might see extra features on its worth charts. If these situations proceed to carry, Ethereum might get away of the consolidation vary and reclaim $3700 ranges.

Nevertheless, if bears outweigh bulls crashing these sentiments, ETH will drop to $3200.

![Devcon: Hacia Colombia en 2022 [Redux]](https://atomicwallet.download/wp-content/uploads/2025/01/upload_2b32fe55f8984608f37d72635a3f8721-350x250.jpg)