Key Notes

- Main Ethereum steadiness holdings surged by $37.32 billion in every week, reaching $479.99 billion.

- A golden crossover on the 4-hour chart and RSI within the overbought zone sign robust bullish momentum.

- Complete internet belongings in Ethereum spot ETFs elevated to $13.03 billion, practically doubling in two months.

- Ethereum eyes a breakout above $3,700, with a bullish goal of $4,109 within the close to time period.

As Bitcoin

BTC

$102 150

24h volatility:

4.0%

Market cap:

$2.02 T

Vol. 24h:

$53.37 B

nears the $100,000 mark, Ethereum

ETH

$3 684

24h volatility:

1.4%

Market cap:

$443.52 B

Vol. 24h:

$23.85 B

has crossed above the $3,600 barrier. With the bullish pattern gaining momentum, the Ethereum market cap is closing in the direction of the $450 billion mark.

Over the previous week, the Ethereum worth managed to bounce 8.5% and continues the bullish restoration this week. Because the optimistic begin to the week hints at an prolonged rally, the Ethereum worth evaluation tasks a possible worth pattern to the $4,000 mark.

Ethereum Worth Trajectory to $4,000

Within the 4-hour worth chart, the Ethereum worth motion showcases a bullish restoration, surpassing the essential provide zone current on the $3,500 mark. Primarily based on the Fibonacci ranges, the bullish pattern in Ethereum has sustained a dominance above the 50% Fibonacci degree at $3,604.

The enhance in shopping for strain has pushed the 4-hour RSI line into the overbought zone. Moreover, the 50 and 200 EMA traces within the 4-hour chart have given a golden crossover.

Therefore, the technical indicators are turning bullish amid the restoration run and sign a shopping for alternative. At present, Ethereum is buying and selling at $3,666 because it faces an early excessive worth rejection from the 61.80% Fibonacci degree at $3,723.

Because the Ethereum bulls are struggling to cross past the $3,700 mark, a short-term pullback is feasible. This may lengthen the consolidation vary between the 50% and 61.80% Fibonacci ranges.

The breakout of both of the essential bounded traces will decide the destiny of the Ethereum worth pattern. A bullish breakout is prone to problem the earlier swing excessive at $4,109.

On the flip facet, the essential help stays at $3,500.

Main Ethereum Steadiness Holdings Rise to Nearly $480 Billion

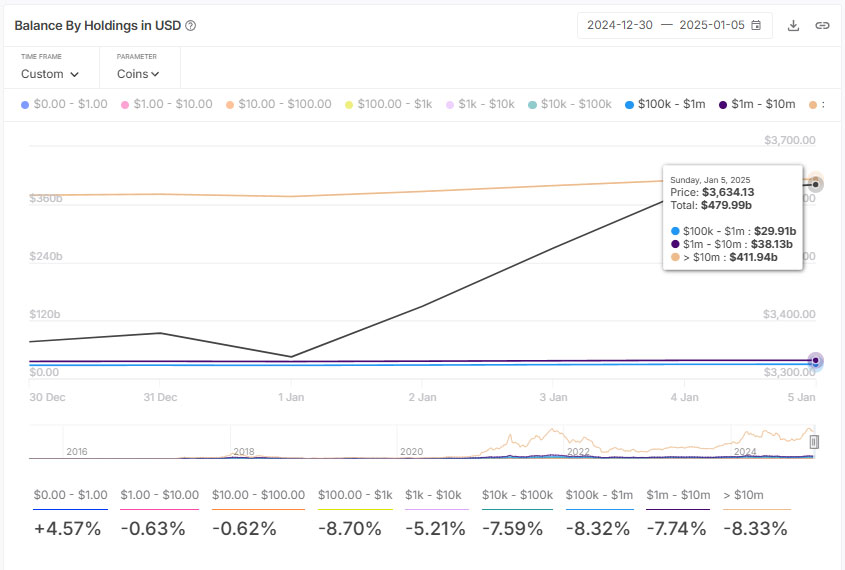

Over the previous 7 days, the Ethereum steadiness by holdings in USD displays a surge in whale holdings. On December 30, the full steadiness between $100,000 to greater than $10 million stood at $442.67 billion.

This has risen to $479.99 billion, rising an enormous improve of $37.32 billion. The key shift comes within the class between the value band of greater than $10 million in funding. This has risen from $379.07 billion to $411.91 billion.

The $100,000 to $1 million worth band elevated from $27.81 billion to $29.91 billion. In the meantime, the $1 million to $10 million worth band has now reached $38.13 billion, ranging from $35.79 billion every week earlier than.

Ethereum ETFs on a Rocky Street

Because the on-chain knowledge suggests a lift in giant buyers, the institutional help is again at 2. On Friday, Jan. 3, the each day internet influx of U.S. Ethereum spot ETFs stood at $58.79 million.

With a powerful closing, the weekly inflows registered a internet outflow of $38.20 million. At present, the full internet belongings stand at $13.03 billion, a big improve from $6.94 billion within the final two months.

Conclusion

Ethereum’s bullish pattern stays robust, with technical indicators and on-chain knowledge exhibiting elevated investor confidence. A breakout above $3,700 may goal $4,109, whereas help at $3,500 offers a security internet. Moreover, the institutional inflows and whale exercise bolster the restoration outlook.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Vishal, a Bachelor of Science graduate, started his journey within the crypto area through the 2021 bull run and has since navigated the next market winter. With a powerful technical background, he’s devoted to delivering insightful articles wealthy in technical particulars, empowering readers to make well-informed choices.