- Bitcoin’s January rally to face a possible pullback as a result of Fed’s upcoming transfer.

- Institutional curiosity and stablecoin exercise proceed to help BTC’s bullish outlook regardless of short-term volatility.

Amid the joy surrounding Donald Trump’s return because the forty seventh U.S. President, the crypto market skilled a notable surge.

But, considerations loom as predictions suggest a possible pullback because the Federal Reserve prepares to launch its first rate of interest determination of the yr.

What to anticipate in Q1?

In response to Markus Thielen, founding father of 10x Analysis, a “constructive begin” in early January may see a slight decline forward of key financial knowledge, adopted by one other rally main as much as Trump’s inauguration on the twentieth of January.

This dynamic creates an intriguing panorama for Bitcoin [BTC] and the broader crypto market within the coming weeks.

Remarking on the identical, Thielen highlighted a probably constructive CPI resultant and stated,

“A good inflation print may reignite optimism, fueling a rally into the Trump inauguration,”

He added,

“Nonetheless, this momentum could wane, with the market seemingly retreating considerably forward of the FOMC assembly on January 29.”

For these unaware, CME Group’s FedWatch device signifies an 88.8% chance that the US federal goal fee will stay between 425 and 450 foundation factors following the upcoming FOMC assembly on twenty ninth January.

What’s Bitcoin value standing?

This comes after Bitcoin skilled a virtually 15% drop to roughly $92,800 following the 18th December FOMC assembly, the place the Federal Reserve decreased its 2025 projected rate of interest cuts from 5 to 2.

In response to Thielen, the Federal Reserve’s upcoming bulletins pose a big threat to any potential BTC rally in 2025, including a layer of uncertainty to the market’s bullish outlook.

“We anticipate decrease inflation this yr, although it could take a while for the Federal Reserve to acknowledge and reply to this shift formally.”

Regardless of short-term volatility, the broader outlook for Bitcoin stays optimistic, pushed by institutional curiosity in stablecoin minting and spot BTC ETF inflows.

Thielen predicts Bitcoin may attain the $97,000 to $98,000 vary by the top of January.

In the meantime, John Glover, Chief Funding Officer at Ledn, anticipates a possible rebound to $125,000 by the top of Q1. He additionally suggests the potential for hitting $160,000 in late 2025 or early 2026.

Right here’s what the indications are saying

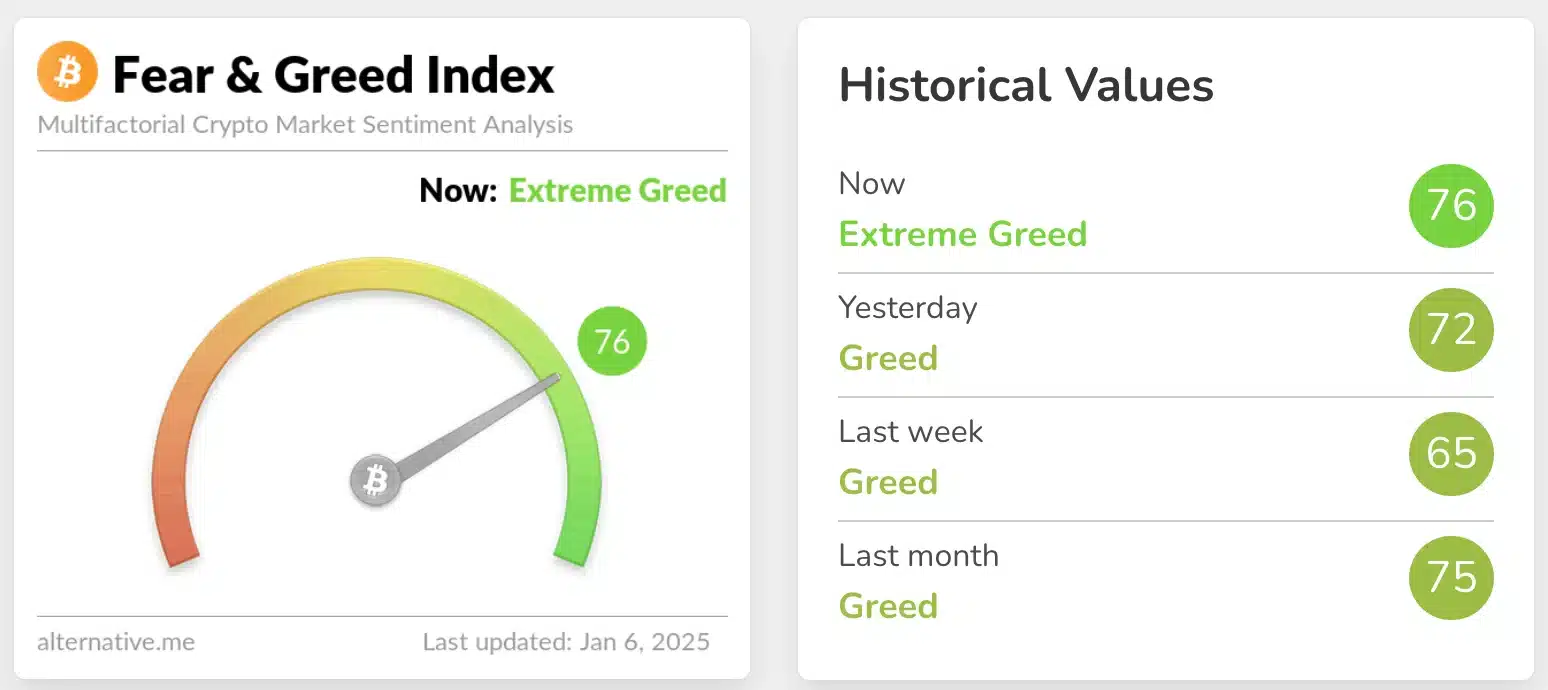

Apparently, the king coin’s Crypto Concern and Greed Index surged to “Excessive Greed,” signaling robust confidence in Bitcoin’s long-term potential, regardless of short-term fluctuations.

Moreover, the Relative Energy Index (RSI), positioned at 57, at press time, additional strengthened Bitcoin’s long-term bullish trajectory.

Thus, whereas Bitcoin’s January rally reveals promise, the Federal Reserve’s financial insurance policies and broader macroeconomic circumstances are key elements that would considerably form its future trajectory.

- Bitcoin’s January rally to face a possible pullback as a result of Fed’s upcoming transfer.

- Institutional curiosity and stablecoin exercise proceed to help BTC’s bullish outlook regardless of short-term volatility.

Amid the joy surrounding Donald Trump’s return because the forty seventh U.S. President, the crypto market skilled a notable surge.

But, considerations loom as predictions suggest a possible pullback because the Federal Reserve prepares to launch its first rate of interest determination of the yr.

What to anticipate in Q1?

In response to Markus Thielen, founding father of 10x Analysis, a “constructive begin” in early January may see a slight decline forward of key financial knowledge, adopted by one other rally main as much as Trump’s inauguration on the twentieth of January.

This dynamic creates an intriguing panorama for Bitcoin [BTC] and the broader crypto market within the coming weeks.

Remarking on the identical, Thielen highlighted a probably constructive CPI resultant and stated,

“A good inflation print may reignite optimism, fueling a rally into the Trump inauguration,”

He added,

“Nonetheless, this momentum could wane, with the market seemingly retreating considerably forward of the FOMC assembly on January 29.”

For these unaware, CME Group’s FedWatch device signifies an 88.8% chance that the US federal goal fee will stay between 425 and 450 foundation factors following the upcoming FOMC assembly on twenty ninth January.

What’s Bitcoin value standing?

This comes after Bitcoin skilled a virtually 15% drop to roughly $92,800 following the 18th December FOMC assembly, the place the Federal Reserve decreased its 2025 projected rate of interest cuts from 5 to 2.

In response to Thielen, the Federal Reserve’s upcoming bulletins pose a big threat to any potential BTC rally in 2025, including a layer of uncertainty to the market’s bullish outlook.

“We anticipate decrease inflation this yr, although it could take a while for the Federal Reserve to acknowledge and reply to this shift formally.”

Regardless of short-term volatility, the broader outlook for Bitcoin stays optimistic, pushed by institutional curiosity in stablecoin minting and spot BTC ETF inflows.

Thielen predicts Bitcoin may attain the $97,000 to $98,000 vary by the top of January.

In the meantime, John Glover, Chief Funding Officer at Ledn, anticipates a possible rebound to $125,000 by the top of Q1. He additionally suggests the potential for hitting $160,000 in late 2025 or early 2026.

Right here’s what the indications are saying

Apparently, the king coin’s Crypto Concern and Greed Index surged to “Excessive Greed,” signaling robust confidence in Bitcoin’s long-term potential, regardless of short-term fluctuations.

Moreover, the Relative Energy Index (RSI), positioned at 57, at press time, additional strengthened Bitcoin’s long-term bullish trajectory.

Thus, whereas Bitcoin’s January rally reveals promise, the Federal Reserve’s financial insurance policies and broader macroeconomic circumstances are key elements that would considerably form its future trajectory.