In a newly launched investor note, one of many oldest US funding banks H.C. Wainwright & Co. —established in 1868—is projecting substantial upswing for the Bitcoin value. Based on the word, the establishment has revised its earlier Bitcoin value goal for the tip of 2025 from $145,000 to $225,000, underpinned by a confluence of historic traits, macroeconomic indicators, and rising regulatory and institutional elements.

“We estimate BTC will attain a cycle excessive of $225,000 by YE2025,” said the agency, referencing each market cycles and the potential for a extra supportive digital-asset regulatory panorama in america in 2025 below a brand new administration.

Why Bitcoin Might $225,000 By Yr Finish

H.C. Wainwright’s evaluation highlights a number of pivotal forces propelling Bitcoin’s development trajectory. One vital catalyst is the broader availability of spot Bitcoin exchange-traded funds (ETFs) within the US, a improvement that would unlock new waves of institutional capital. The agency additionally cites “accelerating institutional investor and company adoption” as a serious contributor to its bullish outlook.

Associated Studying

On prime of that, the funding financial institution’s fashions assume an general market backdrop that improves in tandem with international liquidity and that any regulatory overhang will abate. H.C. Wainwright is cautious to notice that the forecast is delicate to macroeconomic circumstances, significantly measured by M2 money supply, which has trended downward since October.

Although projecting a lofty six-figure value by 2025, H.C. Wainwright acknowledged that Bitcoin’s path towards $225,000 is unlikely to be a clean trip. Within the report, the financial institution cautioned: “~20-30% drawdowns throughout bull markets aren’t unusual […] We estimate BTC might retrace again right down to the mid-$70,000 vary in early 1Q25 earlier than resuming its uptrend.”

They attribute these attainable pullbacks to Bitcoin’s historic volatility and its correlation with international liquidity traits.

Associated Studying

If Bitcoin reaches $225,000 per coin, H.C. Wainwright tasks a complete Bitcoin market capitalization of roughly $4.5 trillion—round 25% of gold’s present $18 trillion market cap. This state of affairs interprets to a 113% improve over present ranges. Nonetheless, the word provides a placing state of affairs that’s not but factored into its core forecast:

“Our new 2025 value goal doesn’t issue within the potential for the US authorities to formally undertake BTC as a treasury reserve asset on the federal stage subsequent 12 months. If applied, we imagine it’s believable that BTC might considerably exceed our base case value goal.”

The establishment’s evaluation additionally extends to the broader crypto market. Traditionally, Bitcoin’s dominance (its share of total crypto market cap) tends to fall throughout market peaks, and it dipped into the low 40% vary close to the final bull cycle peak in November 2021.

Wanting ahead, H.C. Wainwright expects Bitcoin’s dominance to say no to 45% by the tip of 2025, down from round 56% presently. Beneath that assumption, the agency sees the overall crypto market swelling from $3.6 trillion as we speak to roughly $10 trillion by 12 months’s finish 2025.

H.C. Wainwright’s protection universe of publicly traded Bitcoin mining corporations stands to learn from the anticipated value surge. “If our predictions are right, there’s the potential for vital upward estimate revisions for our protection universe over the course of subsequent 12 months.”

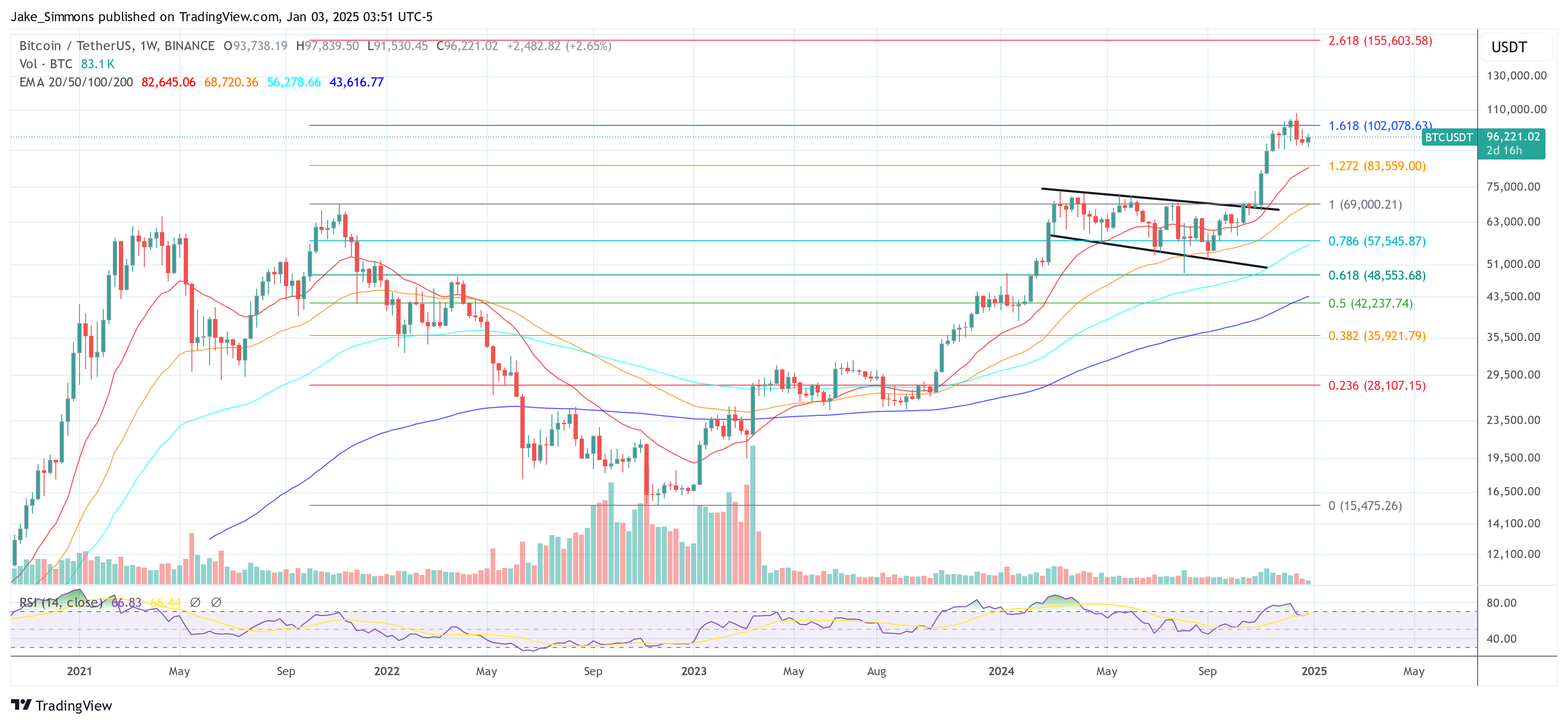

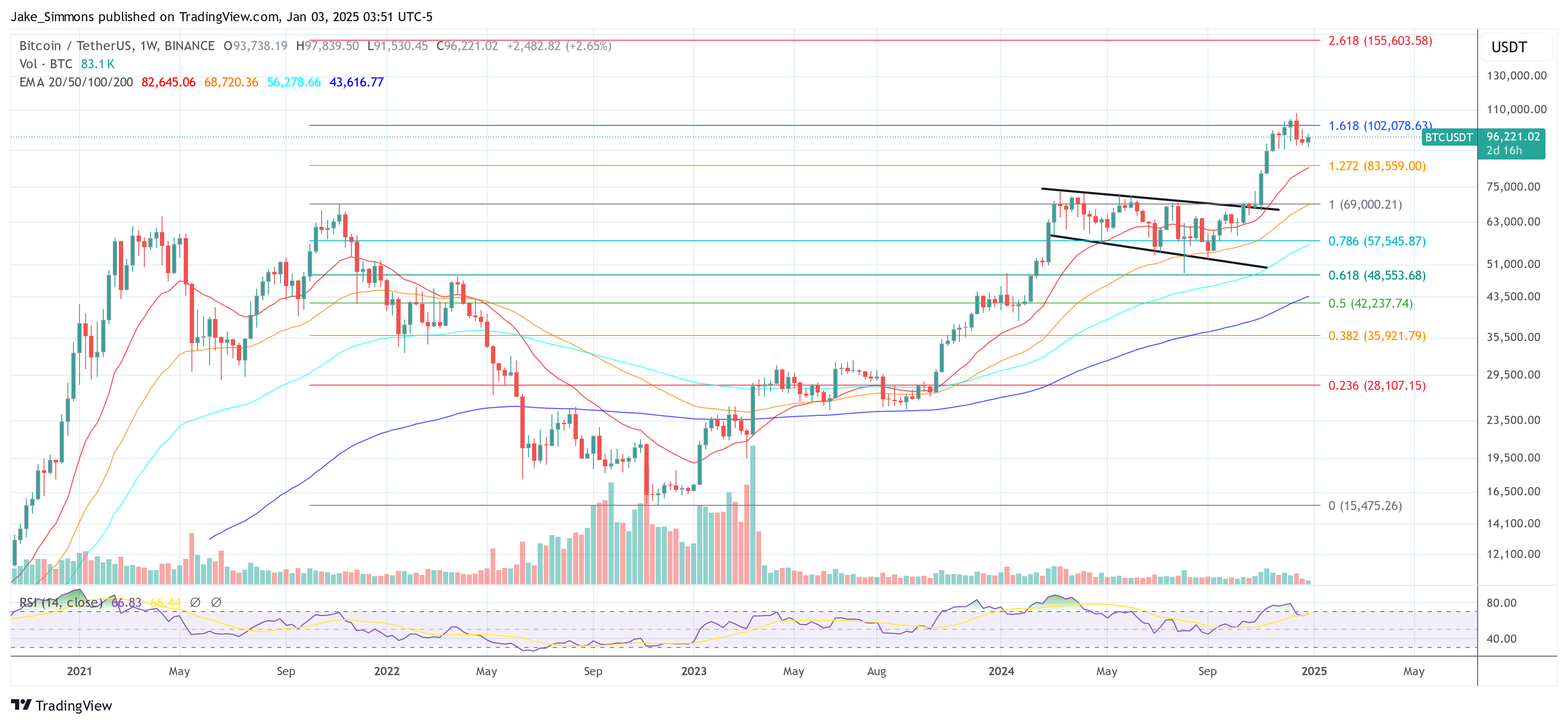

At press time, BTC traded at $96,221.

Featured picture created with DALL.E, chart from TradingView.com

In a newly launched investor note, one of many oldest US funding banks H.C. Wainwright & Co. —established in 1868—is projecting substantial upswing for the Bitcoin value. Based on the word, the establishment has revised its earlier Bitcoin value goal for the tip of 2025 from $145,000 to $225,000, underpinned by a confluence of historic traits, macroeconomic indicators, and rising regulatory and institutional elements.

“We estimate BTC will attain a cycle excessive of $225,000 by YE2025,” said the agency, referencing each market cycles and the potential for a extra supportive digital-asset regulatory panorama in america in 2025 below a brand new administration.

Why Bitcoin Might $225,000 By Yr Finish

H.C. Wainwright’s evaluation highlights a number of pivotal forces propelling Bitcoin’s development trajectory. One vital catalyst is the broader availability of spot Bitcoin exchange-traded funds (ETFs) within the US, a improvement that would unlock new waves of institutional capital. The agency additionally cites “accelerating institutional investor and company adoption” as a serious contributor to its bullish outlook.

Associated Studying

On prime of that, the funding financial institution’s fashions assume an general market backdrop that improves in tandem with international liquidity and that any regulatory overhang will abate. H.C. Wainwright is cautious to notice that the forecast is delicate to macroeconomic circumstances, significantly measured by M2 money supply, which has trended downward since October.

Although projecting a lofty six-figure value by 2025, H.C. Wainwright acknowledged that Bitcoin’s path towards $225,000 is unlikely to be a clean trip. Within the report, the financial institution cautioned: “~20-30% drawdowns throughout bull markets aren’t unusual […] We estimate BTC might retrace again right down to the mid-$70,000 vary in early 1Q25 earlier than resuming its uptrend.”

They attribute these attainable pullbacks to Bitcoin’s historic volatility and its correlation with international liquidity traits.

Associated Studying

If Bitcoin reaches $225,000 per coin, H.C. Wainwright tasks a complete Bitcoin market capitalization of roughly $4.5 trillion—round 25% of gold’s present $18 trillion market cap. This state of affairs interprets to a 113% improve over present ranges. Nonetheless, the word provides a placing state of affairs that’s not but factored into its core forecast:

“Our new 2025 value goal doesn’t issue within the potential for the US authorities to formally undertake BTC as a treasury reserve asset on the federal stage subsequent 12 months. If applied, we imagine it’s believable that BTC might considerably exceed our base case value goal.”

The establishment’s evaluation additionally extends to the broader crypto market. Traditionally, Bitcoin’s dominance (its share of total crypto market cap) tends to fall throughout market peaks, and it dipped into the low 40% vary close to the final bull cycle peak in November 2021.

Wanting ahead, H.C. Wainwright expects Bitcoin’s dominance to say no to 45% by the tip of 2025, down from round 56% presently. Beneath that assumption, the agency sees the overall crypto market swelling from $3.6 trillion as we speak to roughly $10 trillion by 12 months’s finish 2025.

H.C. Wainwright’s protection universe of publicly traded Bitcoin mining corporations stands to learn from the anticipated value surge. “If our predictions are right, there’s the potential for vital upward estimate revisions for our protection universe over the course of subsequent 12 months.”

At press time, BTC traded at $96,221.

Featured picture created with DALL.E, chart from TradingView.com