Bitcoin continued rising in worth over the weekend, reaching a excessive of $98,300 after discovering essential help at $91,405.

The biggest crypto by market cap has risen for six consecutive days, coinciding with ongoing demand and provide dynamics.

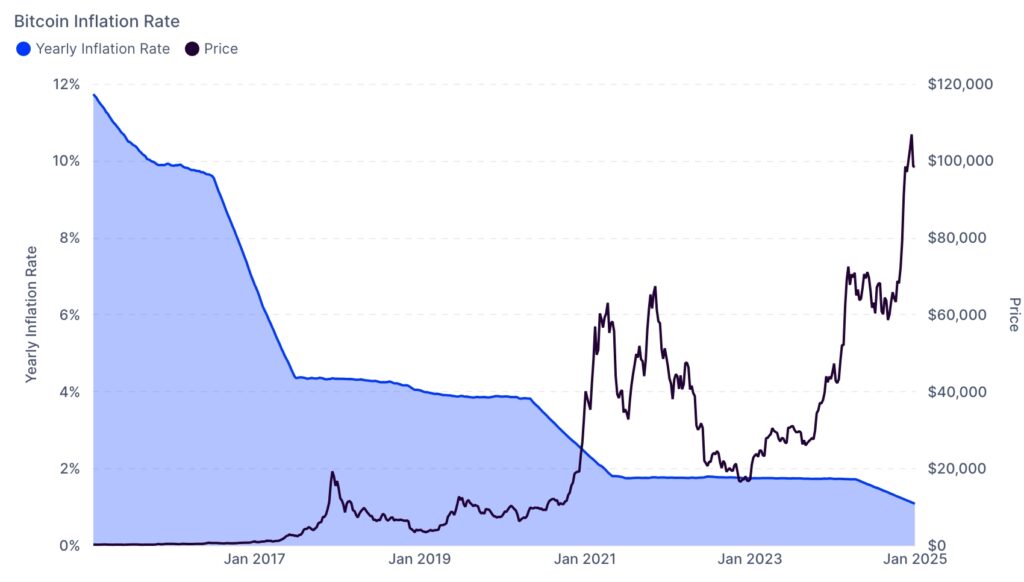

On the availability aspect, the mining issue and hash charge metrics have jumped to their file highs for the reason that final halving occasion in April. This development has pushed the coin’s inflation charge to 1.11%, a lot decrease than the US shopper worth index determine of two.7%.

It is usually decrease than 12%, in comparison with 2016, whereas the quantity of Bitcoin (BTC) in exchanges has continued falling.

Then again, demand is rising as ETF inflows proceed. These funds have amassed over $128 billion in belongings, with BlackRock’s IBIT having over $54 billion.

MicroStrategy has additionally continued its shopping for spree and now holds over 450 cash. Polymarket users count on that the corporate can have over 500,000 cash by March.

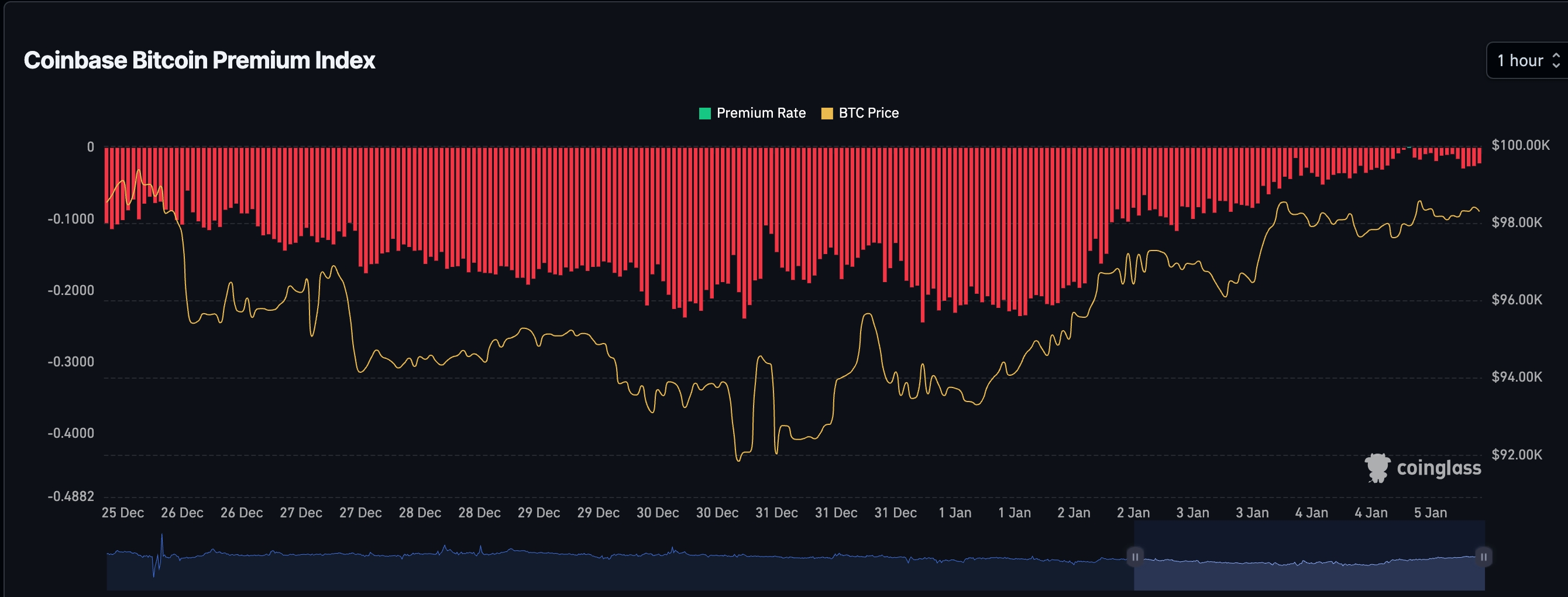

There are indicators that American buyers are shopping for extra Bitcoins. Along with their ETF purchases, information exhibits that the Coinbase Premium Index has recovered after falling sharply in December.

In keeping with CoinGlass, it has moved to minus 0.021, up from minus 0.24 in December.

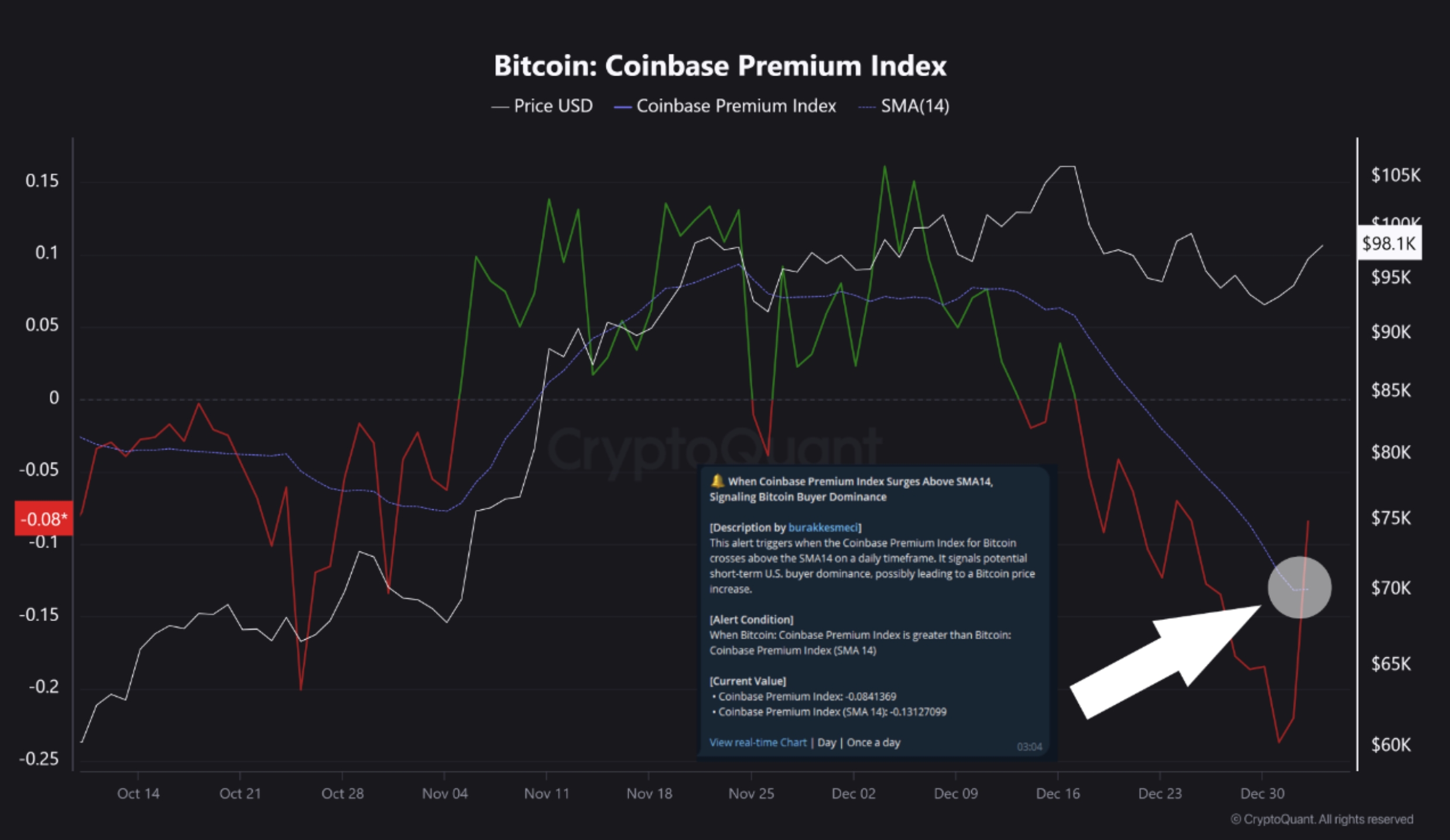

One other information by CryptoQuant exhibits that the index has damaged above the 14-day Easy Shifting Common after 26 days — a optimistic signal for costs.

The Coinbase Premium Index is a vital determine that examines purchases by American buyers, together with establishments. Coinbase is essentially the most broadly used trade in america, so when it rises, it signifies that the largest pool of capital is probably accumulating.

Moreover, Bitcoin faces different elementary catalysts forward, together with President-elect Donald Trump’s inauguration and the upcoming FTX $16 billion distributions.

There are possibilities that a number of the recipients of those funds will put money into Bitcoin and different cash. Additionally, as crypto.information reported final week, Bitcoin’s MVRV ratio continues to be low — an indication that it’s undervalued.

Bitcoin worth evaluation

The every day chart exhibits that BTC has rebounded prior to now few days. It has risen prior to now six straight days and consistently remained above the 50-day shifting common.

Bitcoin has additionally discovered substantial help on the key help at $91,400, the place it failed to maneuver under a number of instances since December.

Subsequently, there are possibilities that it’s going to proceed rising as bulls goal the all-time excessive of $108,000. A transfer above that stage will level to extra positive aspects, doubtlessly to the 38.2% Fibonacci Retracement level at $114,000.

Nonetheless, forming a head and shoulders sample is dangerous. This may occasionally result in a bearish breakdown under $91,400.

Analyst’s bearish take

Analyst Jacob King of WhaleWire not too long ago issued a stark warning about Bitcoin and the broader crypto market, citing indicators of a possible bear market.

In a put up on social media, King highlighted a number of developments, together with MicroStrategy decreasing its Bitcoin purchases, El Salvador seemingly shifting away from crypto-focused insurance policies, and BlackRock promoting important BTC holdings.

King criticized MicroStrategy’s technique as a “large rip-off” and unsustainable. He additionally pointed to Tether (USDT) pausing new minting for over 20 days, coinciding with the coin’s latest worth stagnation.

Labeling the scenario as “the calm earlier than the storm,” King warned {that a} crypto downturn would possibly align with a broader inventory market crash, urging buyers to reassess their dangers.

Ultimately test Sunday, BTC was buying and selling at $98,035.