The Bitcoin market skilled a modest restoration over the previous week following the 15.7% correction within the latter half of December 2024. Amidst this current value achieve, developments from the short-term holders (STH) exercise have revealed vital indications for Bitcoin within the coming days.

Bitcoin STH MVRV At 1.1 With Extra Room To Run

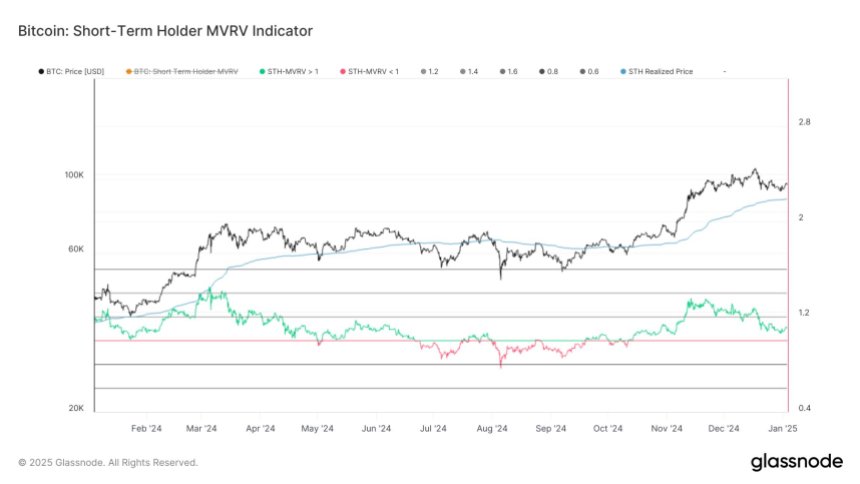

In response to a recent X post, blockchain analytics agency Glassnode shared a knowledge report on the Bitcoin short-term holders’ MVRV ratio in relation to market value.

In crypto, the market worth to realized worth ratio (MVRV) is a essential evaluation device used to gauge whether or not an asset is overvalued or undervalued. Additionally it is used to trace the holders’ profitability with values above 1 indicating revenue and beneath 1 that means a loss.

Based mostly on Glassnode’s report, the Bitcoin STH MVRV ratio at present stands at 1.1 suggesting that short-term holders i.e. traders who acquired Bitcoin inside the previous 155 days, are on common, experiencing a ten% revenue. Contemplating BTC’s value fall in current weeks, there is perhaps elevated promoting strain as these holders transfer to appreciate their positive factors, resulting in short-term value resistance.

Nevertheless, knowledge from Glassnode signifies that the Bitcoin MVRV STH ratio beforehand reached peaks of 1.35 in November 2024, and 1.44 in March 2024. These MVRV values counsel that short-term holders might tolerate greater profitability ranges earlier than triggering a widespread sell-off.

If Bitcoin bulls keep the present value restoration with rising demand, the STH MVRV ratio may rise nearer to those historic peak ranges, which may sign a affirmation of Bitcoin resuming its market uptrend.

BTC Should Keep away from Fall Under $87,000 – Right here’s Why

In relation to the Bitcoin STH MVRV ratio, it’s understood that 1.0, which signifies no revenue or loss, is a pivotal worth performing as a help throughout bullish traits or resistance in a market downtrend.

Glassnode report reveals that the present STH MVRV ratio reveals that 1.0 corresponds with the $87,000 value zone. In response to knowledge from the Cumulative Bid-Ask Delta, there may be an air pocket between $87,000 and $71,000 i.e. there may be low buying and selling exercise or fewer vital purchase orders on this value vary. Subsequently, if the worth of BTC slips beneath $87,000, it should hit no vital help till $71,000 translating into a significant value decline.

On the time of writing, the premier cryptocurrency continues to commerce at $98,081 reflecting a 1.02% achieve prior to now day. With a market cap of $1.94 trillion, Bitcoin continues to rank as the most important asset within the crypto market.