Ethereum has kicked off the brand new 12 months with a powerful efficiency, surging over 9% in only a few days. This rally has introduced renewed optimism to the market, particularly amongst analysts and buyers who had grown involved about Ethereum’s extended underperformance in comparison with Bitcoin. Over the previous months, ETH struggled to keep up momentum, inflicting many to query its near-term potential.

Associated Studying

Nevertheless, high analyst Daan lately shared an insightful chart that has shifted the narrative. In accordance with Daan, Ethereum has traditionally proven important exercise throughout the first quarter of the 12 months, even in durations the place it lagged behind Bitcoin. This pattern underscores Ethereum’s potential for a rebound as market dynamics shift in its favor.

Whereas Ethereum’s value motion is gaining power, the subsequent few weeks can be essential. Traders are watching carefully to see if ETH can sustain this momentum and reclaim dominance throughout the altcoin house. The market’s total sentiment means that 2025 might be a pivotal 12 months for Ethereum, with the Q1 pattern doubtlessly setting the tone for a formidable run forward.

Ethereum Begin To The 12 months Sparks Optimism

Ethereum has begun 2025 on an optimistic observe, with buyers and analysts watching carefully to see if this momentum can maintain. Whereas the beginning of the 12 months has been robust, Ethereum’s efficiency might want to break free from previous tendencies of underperformance relative to Bitcoin to actually thrive within the months forward.

High analyst Daan lately shared a detailed analysis of the ETH/BTC ratio on X, highlighting the historic significance of Q1 for Ethereum. In accordance with Daan, Ethereum has usually seen substantial motion durin.g this era, even in years when it lagged behind Bitcoin.

In the course of the earlier bull cycle in 2020 and 2021, the ETH/BTC ratio skilled important surges that coincided with the beginning of an alt season. This historic knowledge means that Ethereum’s efficiency in Q1 might set the tone for broader market exercise.

For Ethereum to construct on this promising begin, the ~0.04 stage within the ETH/BTC ratio stands as a essential resistance level. A decisive break above this stage might reignite investor confidence and doubtlessly result in important positive factors. Nevertheless, failure to maintain momentum or surpass key ranges may trigger Ethereum to proceed the broader pattern of relative underperformance.

Associated Studying

The following few weeks can be pivotal. If Ethereum can leverage this Q1 power and push previous essential thresholds, 2025 might mark a standout 12 months for the main altcoin.

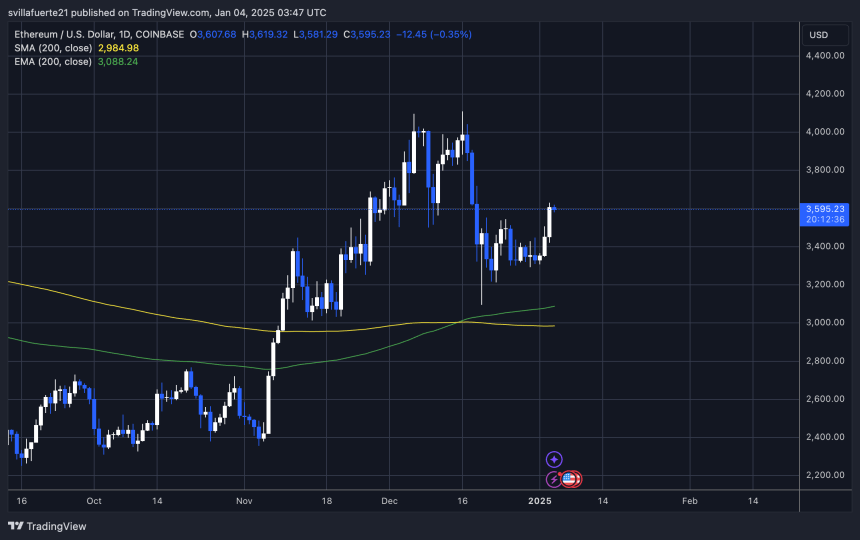

ETH Testing Crucial Zone

Ethereum is buying and selling at $3,595 after reaching a excessive of $3,629 yesterday, testing a essential stage that would decide its short-term route. The worth has proven resilience, bouncing again from the late December dip, however bulls now face the problem of breaking by way of this important resistance to maintain upward momentum.

This stage represents a vital juncture for Ethereum. A breakout above $3,629, adopted by a powerful shut, might sign the beginning of a bullish rally, doubtlessly setting the stage for a transfer towards larger targets within the weeks to return. Nevertheless, the market stays in a section of restoration, with buying and selling exercise reflecting cautious optimism as buyers weigh the potential for continued upward motion.

Regardless of this optimistic outlook, the trail ahead could require endurance. Consolidation across the present ranges is feasible because the market seeks readability and momentum builds. Bulls might want to preserve Ethereum’s place above $3,500 to make sure that the bullish construction stays intact.

Associated Studying

Because the market begins to get up from the seasonal correction, Ethereum’s efficiency at these ranges can be essential. A decisive transfer in both route might set the tone for the altcoin’s trajectory within the coming months, making this a key second for buyers and merchants alike.

Featured picture from Dall-E, chart from TradingView

Ethereum has kicked off the brand new 12 months with a powerful efficiency, surging over 9% in only a few days. This rally has introduced renewed optimism to the market, particularly amongst analysts and buyers who had grown involved about Ethereum’s extended underperformance in comparison with Bitcoin. Over the previous months, ETH struggled to keep up momentum, inflicting many to query its near-term potential.

Associated Studying

Nevertheless, high analyst Daan lately shared an insightful chart that has shifted the narrative. In accordance with Daan, Ethereum has traditionally proven important exercise throughout the first quarter of the 12 months, even in durations the place it lagged behind Bitcoin. This pattern underscores Ethereum’s potential for a rebound as market dynamics shift in its favor.

Whereas Ethereum’s value motion is gaining power, the subsequent few weeks can be essential. Traders are watching carefully to see if ETH can sustain this momentum and reclaim dominance throughout the altcoin house. The market’s total sentiment means that 2025 might be a pivotal 12 months for Ethereum, with the Q1 pattern doubtlessly setting the tone for a formidable run forward.

Ethereum Begin To The 12 months Sparks Optimism

Ethereum has begun 2025 on an optimistic observe, with buyers and analysts watching carefully to see if this momentum can maintain. Whereas the beginning of the 12 months has been robust, Ethereum’s efficiency might want to break free from previous tendencies of underperformance relative to Bitcoin to actually thrive within the months forward.

High analyst Daan lately shared a detailed analysis of the ETH/BTC ratio on X, highlighting the historic significance of Q1 for Ethereum. In accordance with Daan, Ethereum has usually seen substantial motion durin.g this era, even in years when it lagged behind Bitcoin.

In the course of the earlier bull cycle in 2020 and 2021, the ETH/BTC ratio skilled important surges that coincided with the beginning of an alt season. This historic knowledge means that Ethereum’s efficiency in Q1 might set the tone for broader market exercise.

For Ethereum to construct on this promising begin, the ~0.04 stage within the ETH/BTC ratio stands as a essential resistance level. A decisive break above this stage might reignite investor confidence and doubtlessly result in important positive factors. Nevertheless, failure to maintain momentum or surpass key ranges may trigger Ethereum to proceed the broader pattern of relative underperformance.

Associated Studying

The following few weeks can be pivotal. If Ethereum can leverage this Q1 power and push previous essential thresholds, 2025 might mark a standout 12 months for the main altcoin.

ETH Testing Crucial Zone

Ethereum is buying and selling at $3,595 after reaching a excessive of $3,629 yesterday, testing a essential stage that would decide its short-term route. The worth has proven resilience, bouncing again from the late December dip, however bulls now face the problem of breaking by way of this important resistance to maintain upward momentum.

This stage represents a vital juncture for Ethereum. A breakout above $3,629, adopted by a powerful shut, might sign the beginning of a bullish rally, doubtlessly setting the stage for a transfer towards larger targets within the weeks to return. Nevertheless, the market stays in a section of restoration, with buying and selling exercise reflecting cautious optimism as buyers weigh the potential for continued upward motion.

Regardless of this optimistic outlook, the trail ahead could require endurance. Consolidation across the present ranges is feasible because the market seeks readability and momentum builds. Bulls might want to preserve Ethereum’s place above $3,500 to make sure that the bullish construction stays intact.

Associated Studying

Because the market begins to get up from the seasonal correction, Ethereum’s efficiency at these ranges can be essential. A decisive transfer in both route might set the tone for the altcoin’s trajectory within the coming months, making this a key second for buyers and merchants alike.

Featured picture from Dall-E, chart from TradingView

![Devcon: Hacia Colombia en 2022 [Redux]](https://atomicwallet.download/wp-content/uploads/2025/01/upload_2b32fe55f8984608f37d72635a3f8721-350x250.jpg)