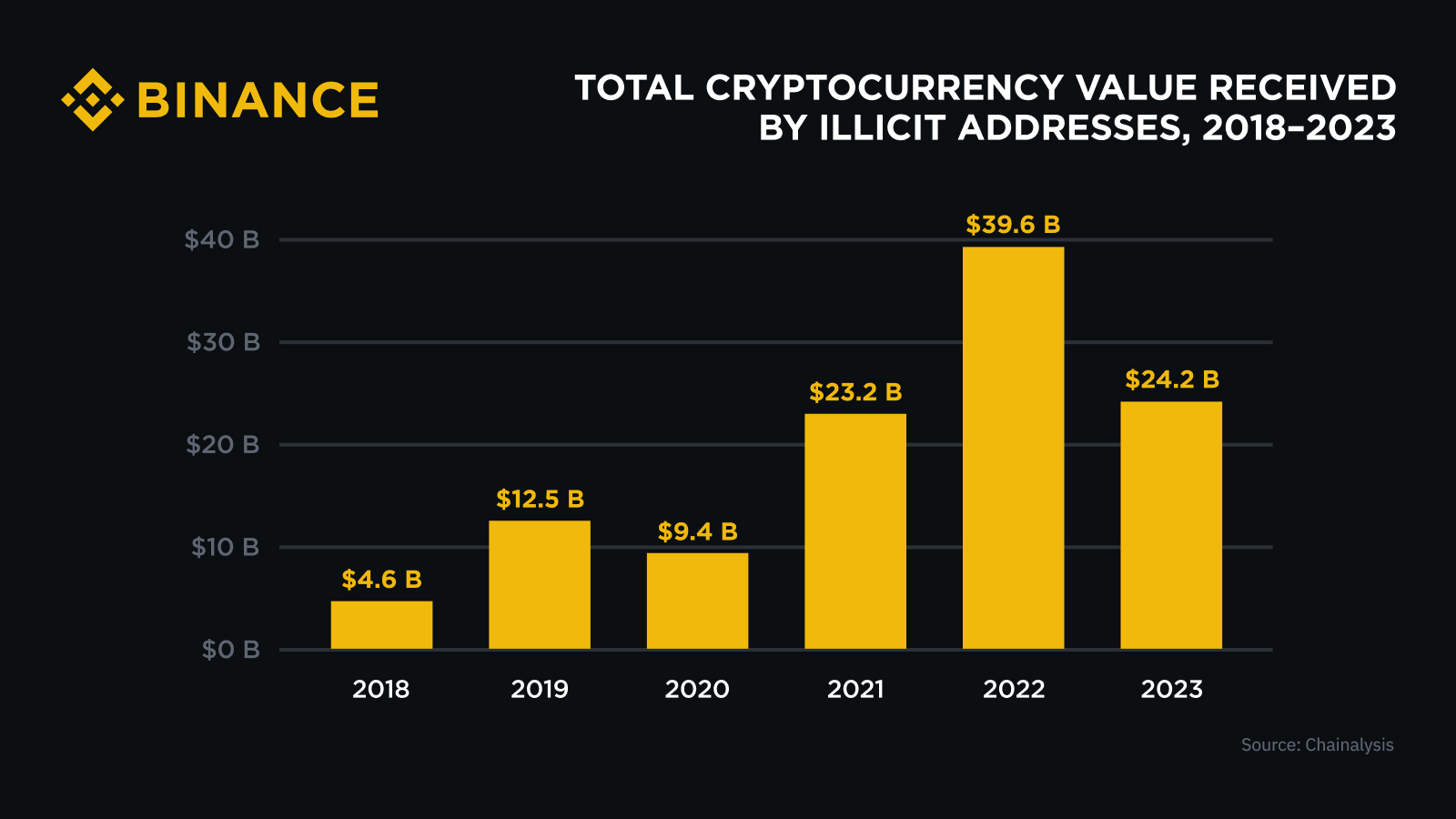

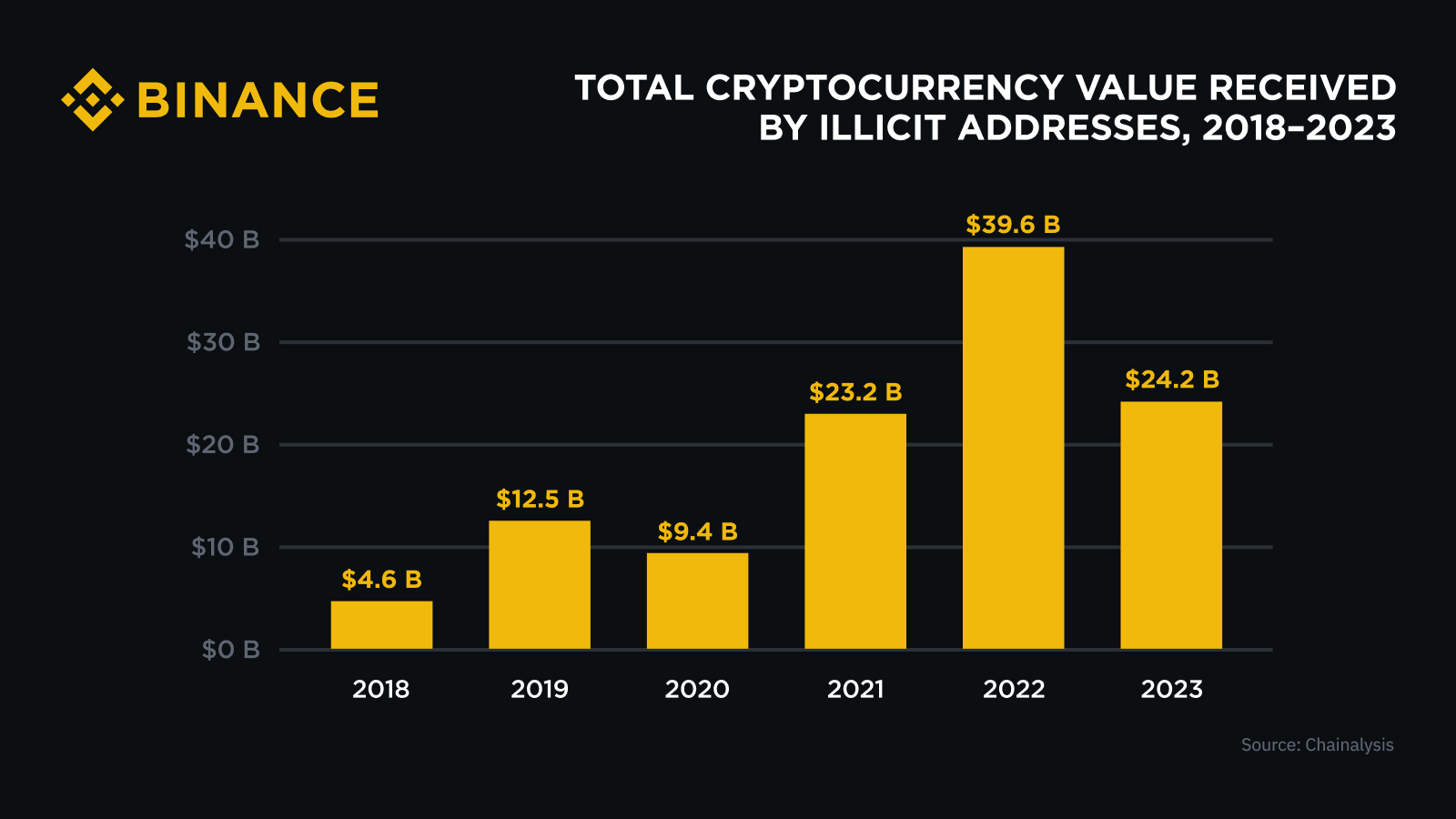

Monetary regulators worldwide are more and more insisting that digital asset service suppliers adjust to the identical guidelines as conventional banks. Amid ongoing debates on privateness and safety, correct AML and KYC measures are instrumental in stopping the illegal use of cryptocurrencies.

Overview of AML and KYC

Within the crypto area, AML practices are important to watch and report suspicious actions, guaranteeing that cryptocurrencies will not be used for cash laundering or terrorism financing.

Know Your Customer (KYC), however, entails verifying the identification of consumers to make sure they’re who they declare to be.

As a part of KYC compliance, crypto companies carry out due diligence on clients to confirm their identification utilizing dependable and unbiased sources reminiscent of government-issued ID, biometric information, and utility payments. These steps are legally required and, when executed appropriately, must be comparatively fast and safe.

How AML and KYC Measures Shield the Crypto Ecosystem

Stopping Unlawful Actions: AML and KYC measures are important in stopping cash laundering and terrorism financing. By verifying buyer identities and monitoring transactions, crypto companies can detect and report suspicious actions.

Making certain Regulatory Compliance: Compliance with AML and KYC rules is necessary for crypto companies to function legally. Regulatory compliance ensures that crypto companies can proceed to function with out going through operational restrictions.

Defending the Agency’s Repute: A sturdy AML and KYC framework enhances a agency’s repute. Prospects and stakeholders usually tend to belief a agency that prioritizes safety and compliance. This belief is essential for long-term success and progress within the extremely aggressive crypto trade.

Nonetheless, crypto companies face many challenges whereas implementing the AML and KYC.

Implementation Challenges for Crypto Corporations

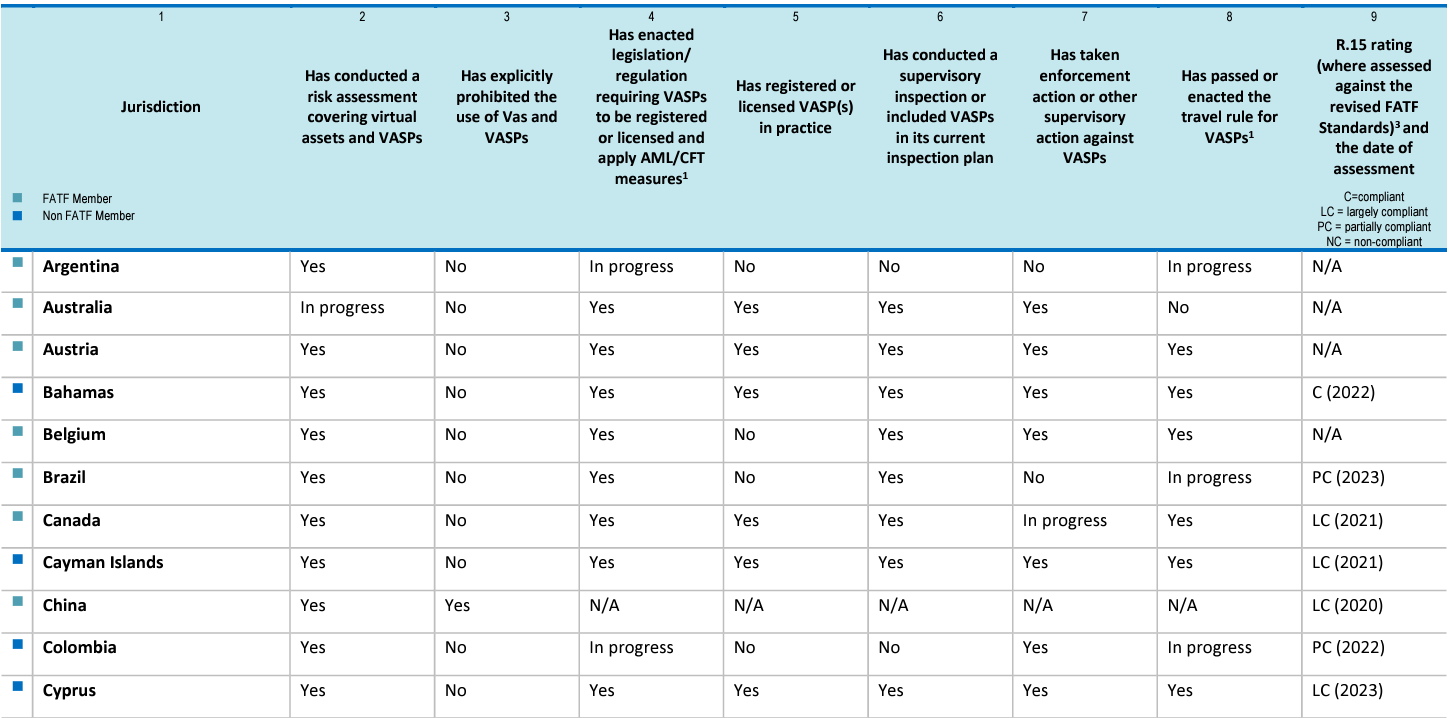

Regulatory Range Throughout Jurisdictions

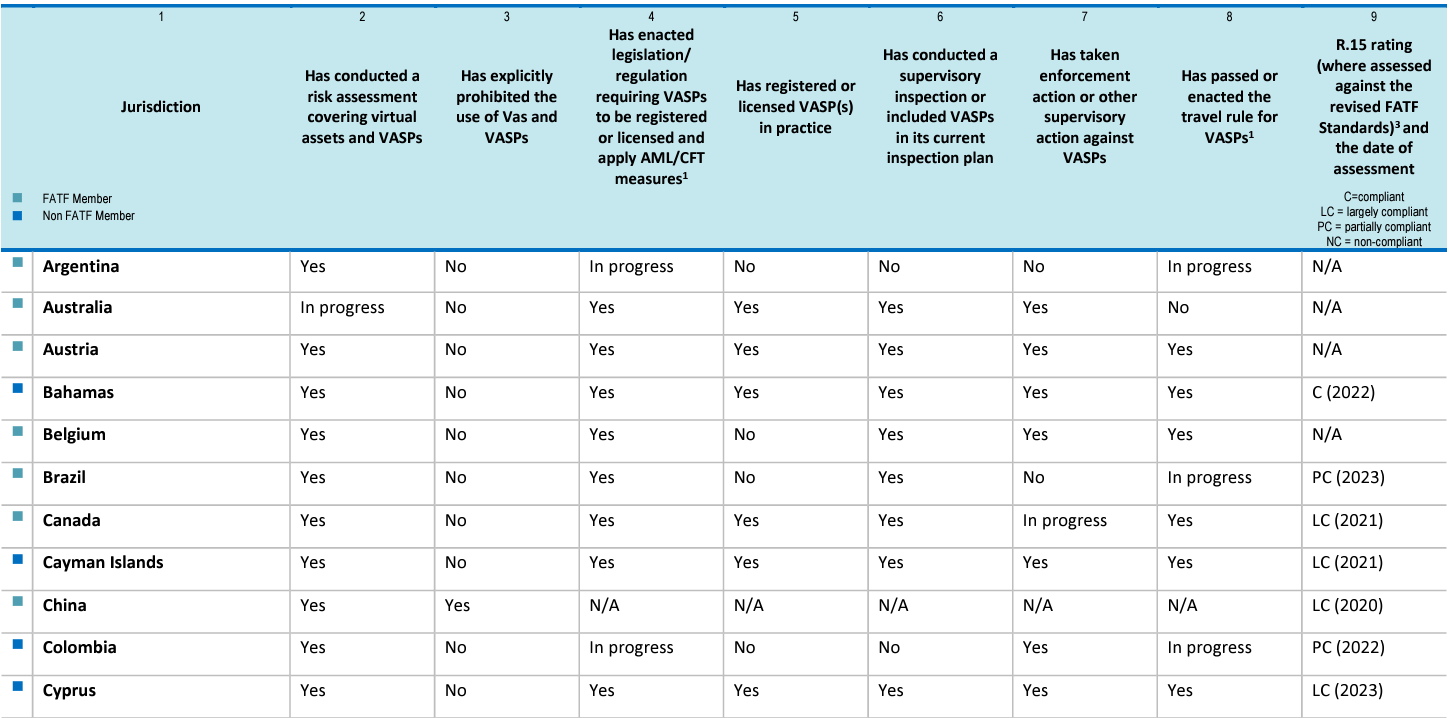

Every nation has its personal algorithm and compliance necessities, making it troublesome for crypto companies working on a world scale to standardize their procedures.

For example, the European Union’s MiCA (Markets in Crypto-Property) regulation mandates particular compliance measures which may differ from these in the US or Asia.

Balancing Safety and Consumer Expertise

Implementing strong AML and KYC protocols can generally hinder consumer expertise. Overly rigorous compliance processes can lead to longer onboarding instances and potential buyer drop-offs.

For instance, extreme identification verification steps can deter new customers from signing up. Conversely, lax safety measures can expose the agency to monetary crimes and regulatory penalties. Reaching this steadiness is essential for the agency’s repute and buyer belief.

Although there are challenges, crypto companies should adjust to complete KYC and AML pointers..

“Some crypto companies don’t take AML/KYC obligations severely, or they find out about their issues however nonetheless want to not implement good AML/KYC programs in place as a result of it may result in the lower of their earnings. Nonetheless, in consequence we witness – they face imprisonment and fines.” — Niko Demchuk, Lawyer and Head of Compliance at AMLBot.

Case Examine 1: Paxful Inc.

Background: Paxful Inc. operated a peer-to-peer digital foreign money platform permitting customers to commerce varied objects, together with fiat foreign money and present playing cards. From 2015 to 2019, the platform failed to keep up efficient AML and KYC applications, resulting in extreme penalties.

Points: The co-founder and former CTO, Artur Schaback, allowed customers to open accounts with out ample KYC data. Paxful marketed itself as a platform not requiring KYC, presenting pretend AML insurance policies to 3rd events. Regardless of suspicious actions, no suspicious exercise experiences had been filed.

Penalties: Schaback pleaded responsible to failing to implement an efficient AML program, resulting in Paxful turning into a car for cash laundering, sanctions violations, and different felony actions. Schaback faces a most penalty of 5 years in jail within the US, highlighting the extreme repercussions of non-compliance.

Classes Realized from Paxful:

- Significance of Real AML/KYC Packages: Pretend insurance policies or lack of enforcement can result in extreme authorized penalties and injury to repute.

- Want for Vigilance: Common monitoring and reporting of suspicious actions are essential to forestall misuse of platforms for illicit actions.

- Regulatory Alignment: Steady alignment with regulatory necessities is important to keep away from authorized penalties.

Case Examine 2: Payeer

Background: Payeer, a digital foreign money operator registered in Lithuania, was fined for almost €9.3 million for violating worldwide sanctions and AML legal guidelines.

Points: Payeer allowed transactions in Russian rubles by way of banks sanctioned by the European Union. The corporate didn’t correctly determine and confirm buyer identities, continued sanction-violating transactions, and didn’t notify authorities about important transactions.

Penalties: Payeer was fined €8.236 million for violating sanctions legal guidelines and €1.06 million for failing to inform the Monetary Crimes Investigation Service (FNTT) about buyer transactions. The corporate’s non-compliance spanned over 1.5 years, involving 213,000 clients and producing income of over €164 million.

Classes Realized from Payeer

- Strict Adherence to Sanctions: Ignoring worldwide sanctions can lead to substantial fines and operational disruption.

- Complete Buyer Verification: Correct identification and verification of consumers are crucial to forestall illicit actions.

- Well timed Reporting: Immediate notification of suspicious transactions to authorities is important to keep up compliance and keep away from penalties.

Overcoming Implementation Challenges

Strategic Planning: Crypto companies should develop strategic plans that incorporate compliance from the outset. This consists of budgeting for expertise investments and hiring expert compliance professionals.

Steady Monitoring: Common audits and steady monitoring of transactions might help determine and mitigate dangers promptly. Implementing automated programs for real-time monitoring can improve effectivity.

Collaboration with Authorities: Partaking with regulatory our bodies and collaborating in trade boards might help companies keep up to date on regulatory modifications and adapt accordingly.

Leveraging Expertise: Using superior applied sciences like blockchain analytics, AI and machine studying can improve the effectiveness of AML and KYC applications, guaranteeing complete oversight.

AMLBot exemplifies a complete answer that addresses these challenges by offering an built-in compliance platform. By providing a wide range of providers, together with KYT/Wallet Screening, KYC, and AML, the platform ensures environment friendly, dependable, and cost-effective AML and KYC processes.

Because the crypto trade evolves, strong AML and KYC frameworks will stay important for fostering belief, safety, and compliance.

Monetary regulators worldwide are more and more insisting that digital asset service suppliers adjust to the identical guidelines as conventional banks. Amid ongoing debates on privateness and safety, correct AML and KYC measures are instrumental in stopping the illegal use of cryptocurrencies.

Overview of AML and KYC

Within the crypto area, AML practices are important to watch and report suspicious actions, guaranteeing that cryptocurrencies will not be used for cash laundering or terrorism financing.

Know Your Customer (KYC), however, entails verifying the identification of consumers to make sure they’re who they declare to be.

As a part of KYC compliance, crypto companies carry out due diligence on clients to confirm their identification utilizing dependable and unbiased sources reminiscent of government-issued ID, biometric information, and utility payments. These steps are legally required and, when executed appropriately, must be comparatively fast and safe.

How AML and KYC Measures Shield the Crypto Ecosystem

Stopping Unlawful Actions: AML and KYC measures are important in stopping cash laundering and terrorism financing. By verifying buyer identities and monitoring transactions, crypto companies can detect and report suspicious actions.

Making certain Regulatory Compliance: Compliance with AML and KYC rules is necessary for crypto companies to function legally. Regulatory compliance ensures that crypto companies can proceed to function with out going through operational restrictions.

Defending the Agency’s Repute: A sturdy AML and KYC framework enhances a agency’s repute. Prospects and stakeholders usually tend to belief a agency that prioritizes safety and compliance. This belief is essential for long-term success and progress within the extremely aggressive crypto trade.

Nonetheless, crypto companies face many challenges whereas implementing the AML and KYC.

Implementation Challenges for Crypto Corporations

Regulatory Range Throughout Jurisdictions

Every nation has its personal algorithm and compliance necessities, making it troublesome for crypto companies working on a world scale to standardize their procedures.

For example, the European Union’s MiCA (Markets in Crypto-Property) regulation mandates particular compliance measures which may differ from these in the US or Asia.

Balancing Safety and Consumer Expertise

Implementing strong AML and KYC protocols can generally hinder consumer expertise. Overly rigorous compliance processes can lead to longer onboarding instances and potential buyer drop-offs.

For instance, extreme identification verification steps can deter new customers from signing up. Conversely, lax safety measures can expose the agency to monetary crimes and regulatory penalties. Reaching this steadiness is essential for the agency’s repute and buyer belief.

Although there are challenges, crypto companies should adjust to complete KYC and AML pointers..

“Some crypto companies don’t take AML/KYC obligations severely, or they find out about their issues however nonetheless want to not implement good AML/KYC programs in place as a result of it may result in the lower of their earnings. Nonetheless, in consequence we witness – they face imprisonment and fines.” — Niko Demchuk, Lawyer and Head of Compliance at AMLBot.

Case Examine 1: Paxful Inc.

Background: Paxful Inc. operated a peer-to-peer digital foreign money platform permitting customers to commerce varied objects, together with fiat foreign money and present playing cards. From 2015 to 2019, the platform failed to keep up efficient AML and KYC applications, resulting in extreme penalties.

Points: The co-founder and former CTO, Artur Schaback, allowed customers to open accounts with out ample KYC data. Paxful marketed itself as a platform not requiring KYC, presenting pretend AML insurance policies to 3rd events. Regardless of suspicious actions, no suspicious exercise experiences had been filed.

Penalties: Schaback pleaded responsible to failing to implement an efficient AML program, resulting in Paxful turning into a car for cash laundering, sanctions violations, and different felony actions. Schaback faces a most penalty of 5 years in jail within the US, highlighting the extreme repercussions of non-compliance.

Classes Realized from Paxful:

- Significance of Real AML/KYC Packages: Pretend insurance policies or lack of enforcement can result in extreme authorized penalties and injury to repute.

- Want for Vigilance: Common monitoring and reporting of suspicious actions are essential to forestall misuse of platforms for illicit actions.

- Regulatory Alignment: Steady alignment with regulatory necessities is important to keep away from authorized penalties.

Case Examine 2: Payeer

Background: Payeer, a digital foreign money operator registered in Lithuania, was fined for almost €9.3 million for violating worldwide sanctions and AML legal guidelines.

Points: Payeer allowed transactions in Russian rubles by way of banks sanctioned by the European Union. The corporate didn’t correctly determine and confirm buyer identities, continued sanction-violating transactions, and didn’t notify authorities about important transactions.

Penalties: Payeer was fined €8.236 million for violating sanctions legal guidelines and €1.06 million for failing to inform the Monetary Crimes Investigation Service (FNTT) about buyer transactions. The corporate’s non-compliance spanned over 1.5 years, involving 213,000 clients and producing income of over €164 million.

Classes Realized from Payeer

- Strict Adherence to Sanctions: Ignoring worldwide sanctions can lead to substantial fines and operational disruption.

- Complete Buyer Verification: Correct identification and verification of consumers are crucial to forestall illicit actions.

- Well timed Reporting: Immediate notification of suspicious transactions to authorities is important to keep up compliance and keep away from penalties.

Overcoming Implementation Challenges

Strategic Planning: Crypto companies should develop strategic plans that incorporate compliance from the outset. This consists of budgeting for expertise investments and hiring expert compliance professionals.

Steady Monitoring: Common audits and steady monitoring of transactions might help determine and mitigate dangers promptly. Implementing automated programs for real-time monitoring can improve effectivity.

Collaboration with Authorities: Partaking with regulatory our bodies and collaborating in trade boards might help companies keep up to date on regulatory modifications and adapt accordingly.

Leveraging Expertise: Using superior applied sciences like blockchain analytics, AI and machine studying can improve the effectiveness of AML and KYC applications, guaranteeing complete oversight.

AMLBot exemplifies a complete answer that addresses these challenges by offering an built-in compliance platform. By providing a wide range of providers, together with KYT/Wallet Screening, KYC, and AML, the platform ensures environment friendly, dependable, and cost-effective AML and KYC processes.

Because the crypto trade evolves, strong AML and KYC frameworks will stay important for fostering belief, safety, and compliance.