- Stablecoin reserves and SSR traits prompt sturdy shopping for energy and imminent Bitcoin rally potential.

- Technical indicators and liquidations confirmed bullish sentiment, with $110,000 as a sensible goal.

Bitcoin’s [BTC] newest worth surge has sparked discussions, fueled by Binance’s huge stablecoin reserves and constructive market traits. These reserves reached $44.5 billion on the thirty first of December, showcasing immense shopping for energy poised to drive BTC greater.

Bitcoin was buying and selling at $93,592.03, at press time, up 1.20% previously 24 hours. This mix of liquidity and momentum makes the cryptocurrency market’s outlook more and more bullish.

How stablecoin reserves ignite Bitcoin rallies

Stablecoins present prompt liquidity, usually appearing as a catalyst for Bitcoin worth will increase. Traditionally, vital inflows of stablecoins to exchanges have led to BTC rallies by growing demand.

As an example, in the course of the rally on the eleventh of December, a surge in stablecoin exercise helped Bitcoin achieve 4.7% in in the future. Subsequently, the present reserve ranges recommend an identical rally may quickly happen, reinforcing investor optimism.

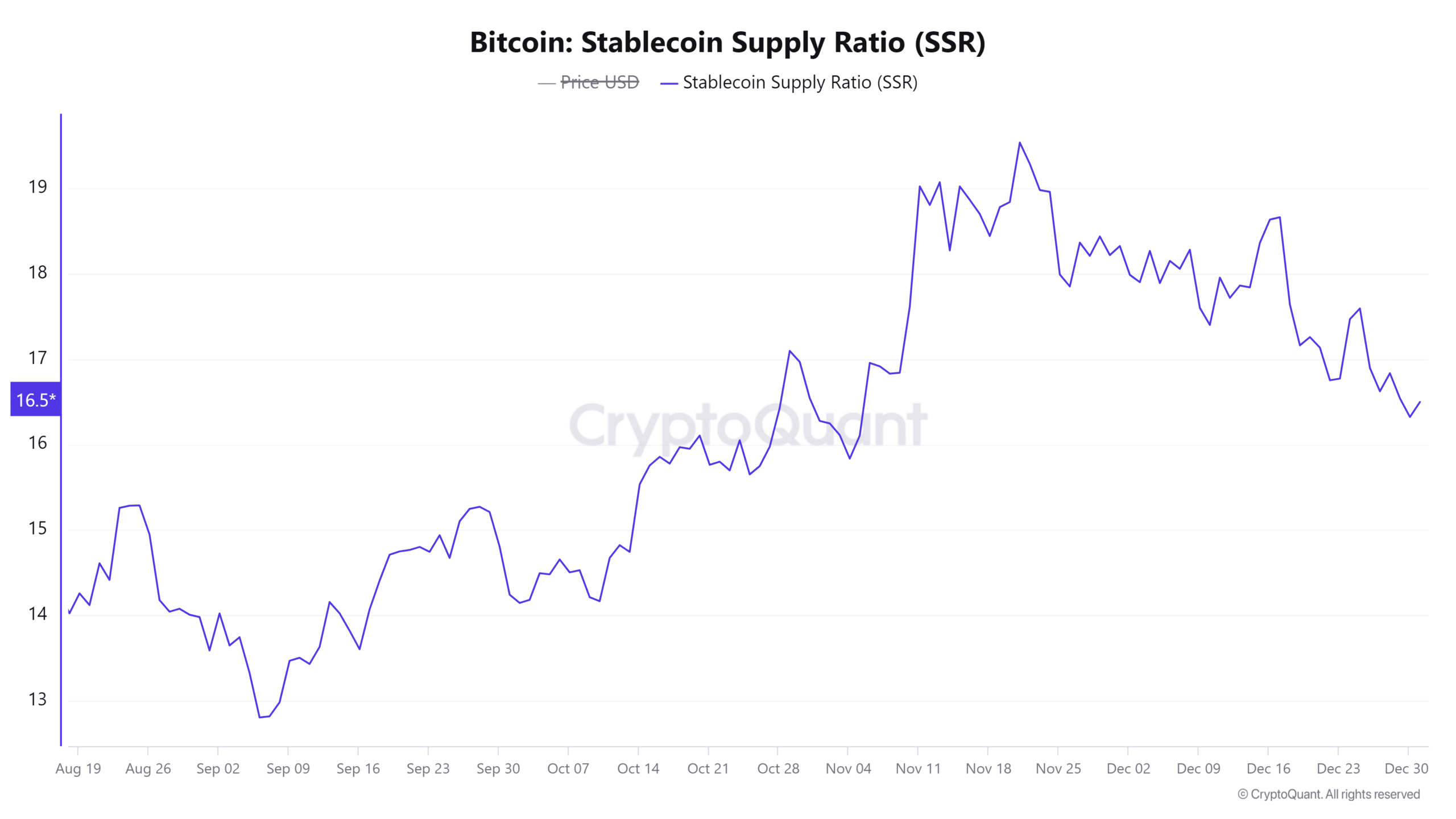

Does the SSR trace at extra upward potential?

The Stablecoin Provide Ratio (SSR) is a key metric that signifies Bitcoin’s development potential. At present at 16.55, with a 1.01% each day enhance, the SSR displays ample liquidity in comparison with Bitcoin’s market cap.

This implies a positive setting for Bitcoin’s worth to rise, as there may be extra stablecoin liquidity obtainable to gas demand. Consequently, SSR traits strongly help the opportunity of continued upward momentum.

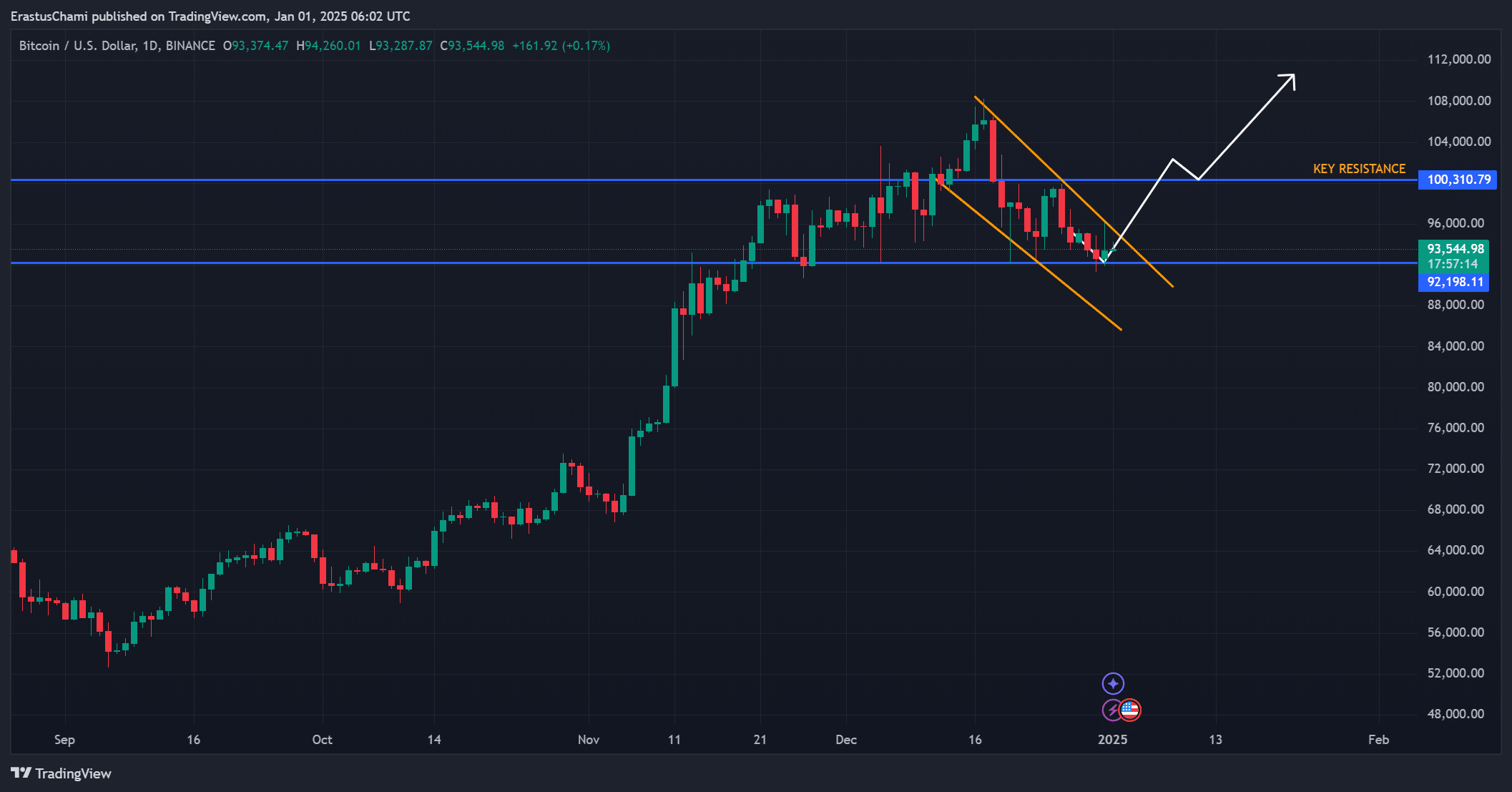

BTC worth motion: Is a breakout imminent?

Bitcoin’s worth has rebounded from the demand zone at $92,198.11 and is now approaching a possible breakout from a descending wedge. Traditionally, such patterns point out bullish reversals, and Bitcoin’s motion suggests an identical final result.

Key resistance at $100,310.79 may pave the way in which for a mid-term goal of $110,000. Subsequently, BTC’s worth motion strongly signifies a continuation of the present uptrend.

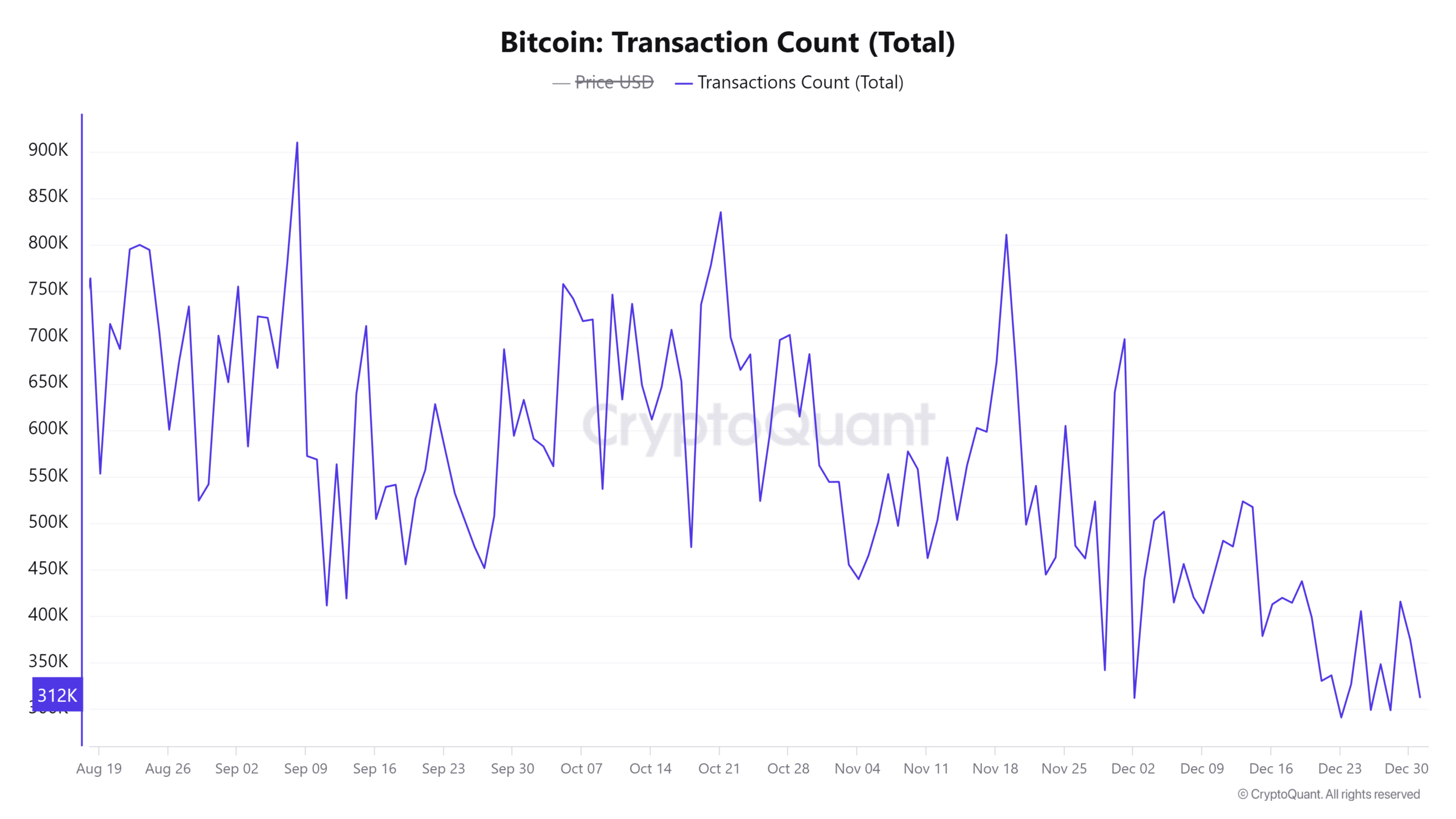

Transaction traits verify investor confidence

Transaction counts reveal constant exercise, with 312,056 recorded at press time, marking a 0.92% enhance over 24 hours. This metric signifies heightened participation within the Bitcoin community, sometimes noticed when traders are actively accumulating.

Subsequently, the regular transaction quantity reinforces constructive sentiment and suggests sturdy market engagement shifting ahead.

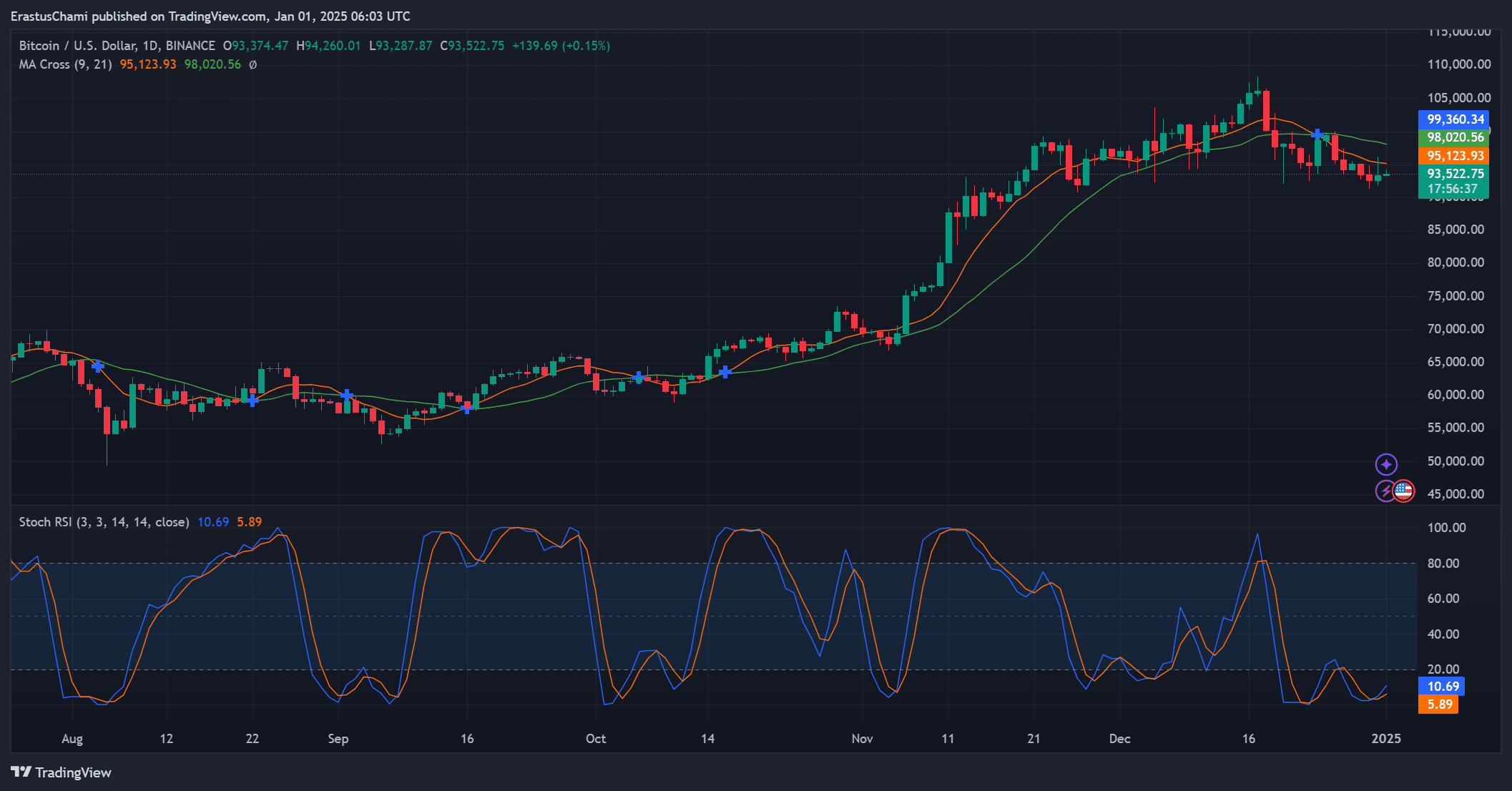

Technical indicators help additional good points

Technical evaluation highlights BTC’s bullish potential. The Stochastic RSI exhibits an oversold situation of 10.69, suggesting an upward reversal is imminent.

Furthermore, the 9-day Transferring Common(MA) at $95,123.93 remained above the 21-day MA at $98,020.56, indicating sturdy shopping for momentum. These alerts collectively forecast a continuation of Bitcoin’s rally.

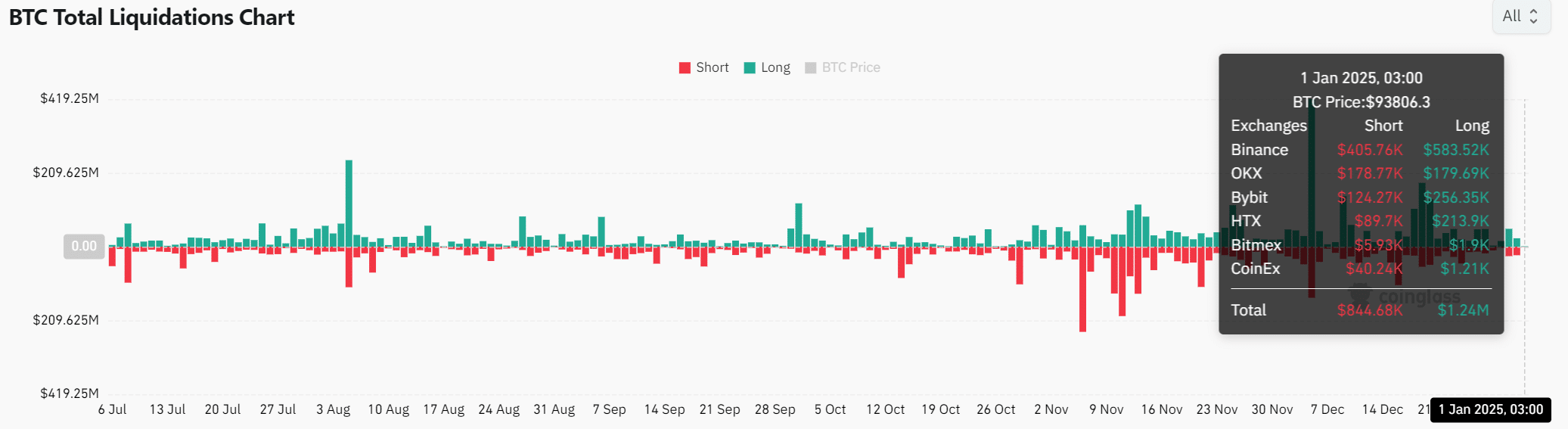

BTC liquidations reveal bullish market sentiment

Liquidation knowledge exhibits a dominant bullish sentiment, with $1.24 million in lengthy positions cleared in comparison with $844,000 in brief liquidations.

This imbalance underscores vital shopping for stress, additional confirming the market’s confidence in BTC’s upward trajectory. Moreover, it means that bullish momentum will doubtless persist within the close to time period.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Binance’s $44.5 billion stablecoin reserves current immense liquidity that strongly helps BTC’s ongoing rally.

Mixed with technical and transaction traits, traders can confidently anticipate Bitcoin reaching $110,000 within the mid-term.