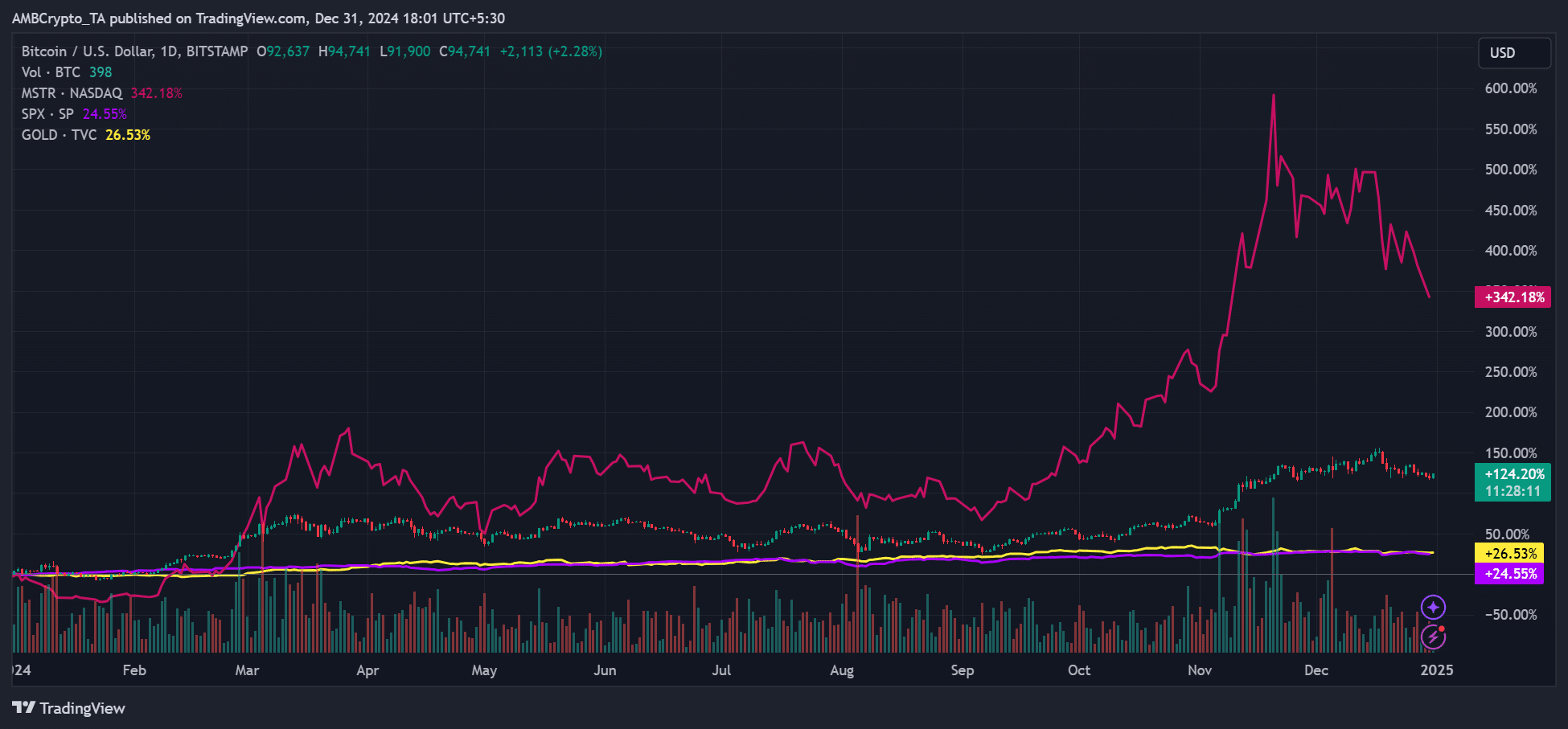

- MicroStrategy’s MSTR noticed 342% yearly features in comparison with BTC’s 122%.

- Nevertheless, ongoing BTC weakening may drag MSTR decrease in January.

MicroStrategy purchased one other 2,138 Bitcoins ($209 million) on the finish of the 12 months, bringing its general holdings to 446.4K cash, price over $41 billion.

The pioneer within the BTC company treasury now holds 2.12% of the whole BTC provide, and the first beneficiary has been MSTR shareholders.

On a YTD (year-to-date) foundation, MSTR logged 342% features, whereas BTC logged 122% over the identical interval.

That meant MSTR traders outperformed their BTC counterparts by practically 3x in 2024. Curiously, each property eclipsed gold and US shares (S&P 500) which tapped 26% and 24% yearly features, respectively.

So, what’s subsequent for BTC and MicroStrategy in 2025?

The agency plans to broaden its fairness issuance program to 10 billion MSTR shares to speed up its BTC shopping for spree. Most analysts imagine this might pump BTC’s worth.

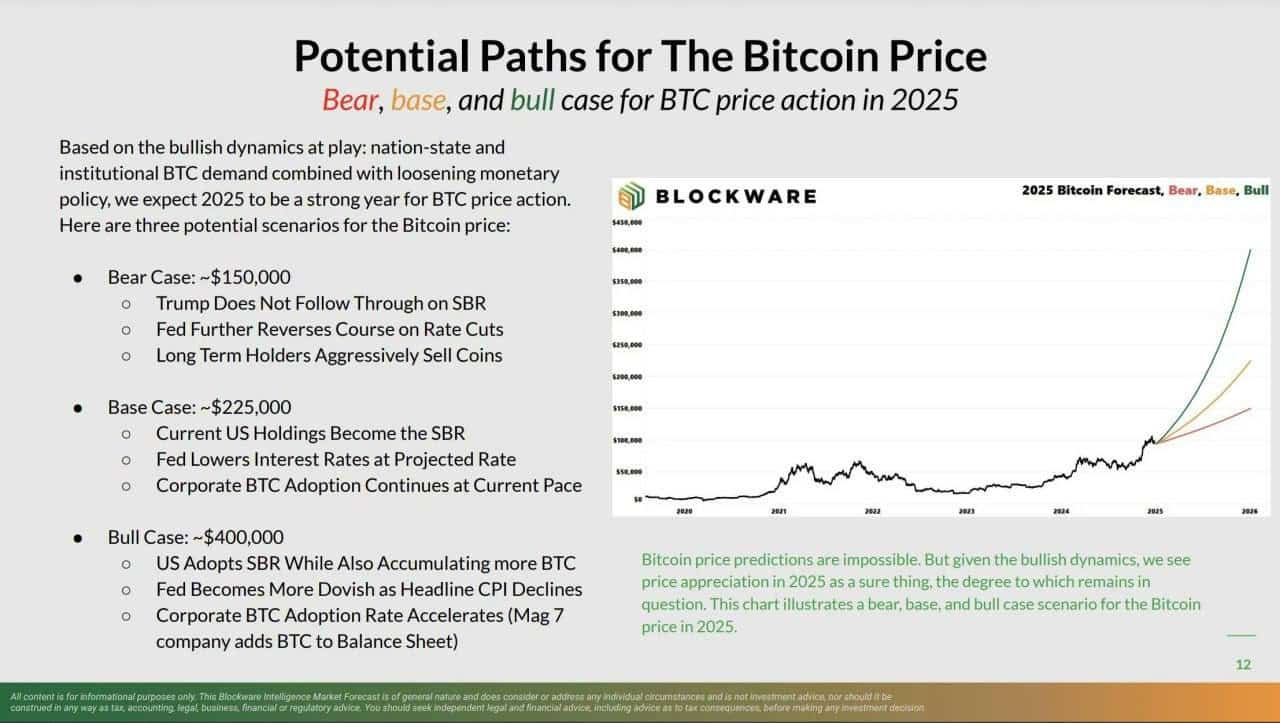

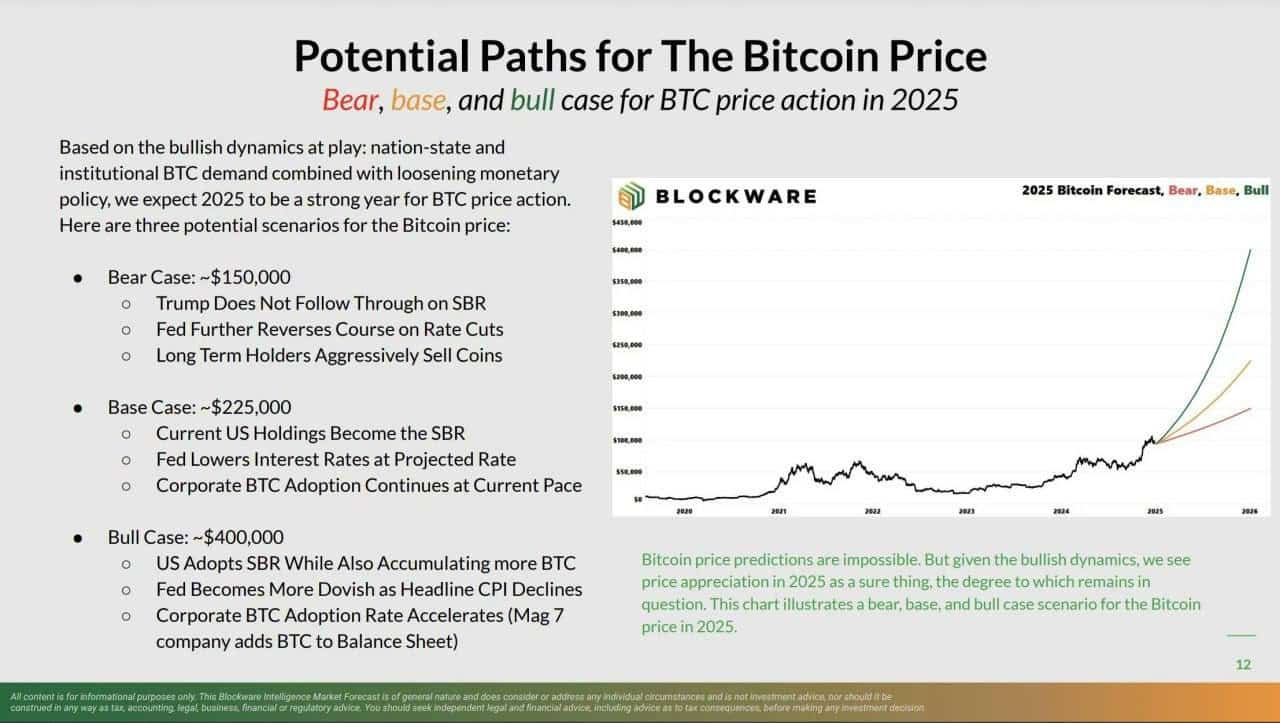

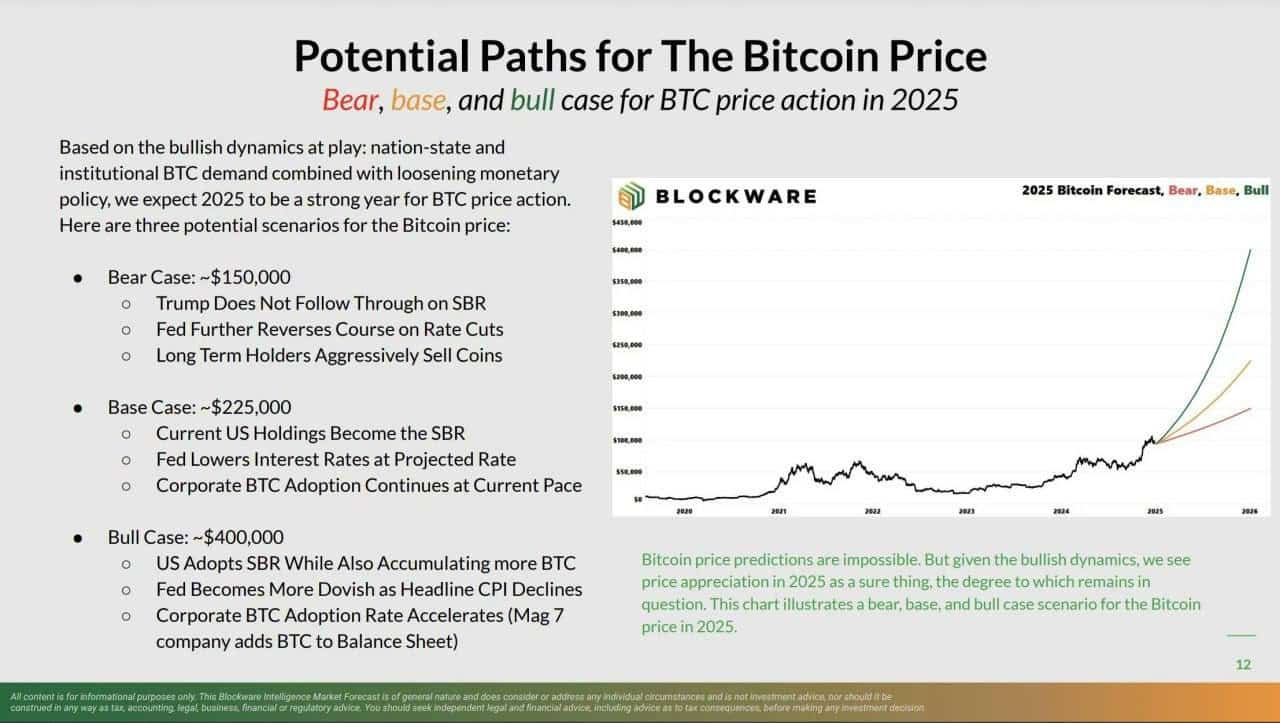

In actual fact, Blockware projected that BTC may hit $225K or $400K in 2025 if BTC company treasury adoption accelerates alongside the creation of a US BTC strategic reserve.

Supply: Blockware

Nevertheless, in line with the Blockware staff, BTC may solely attain $150K in a ‘bear case’ state of affairs.

Nevertheless, QCP Capital predicted that BTC may stay muted into January, citing seasonality traits. If that’s the case, MSTR’s short-term features might be capped till the market recovers.

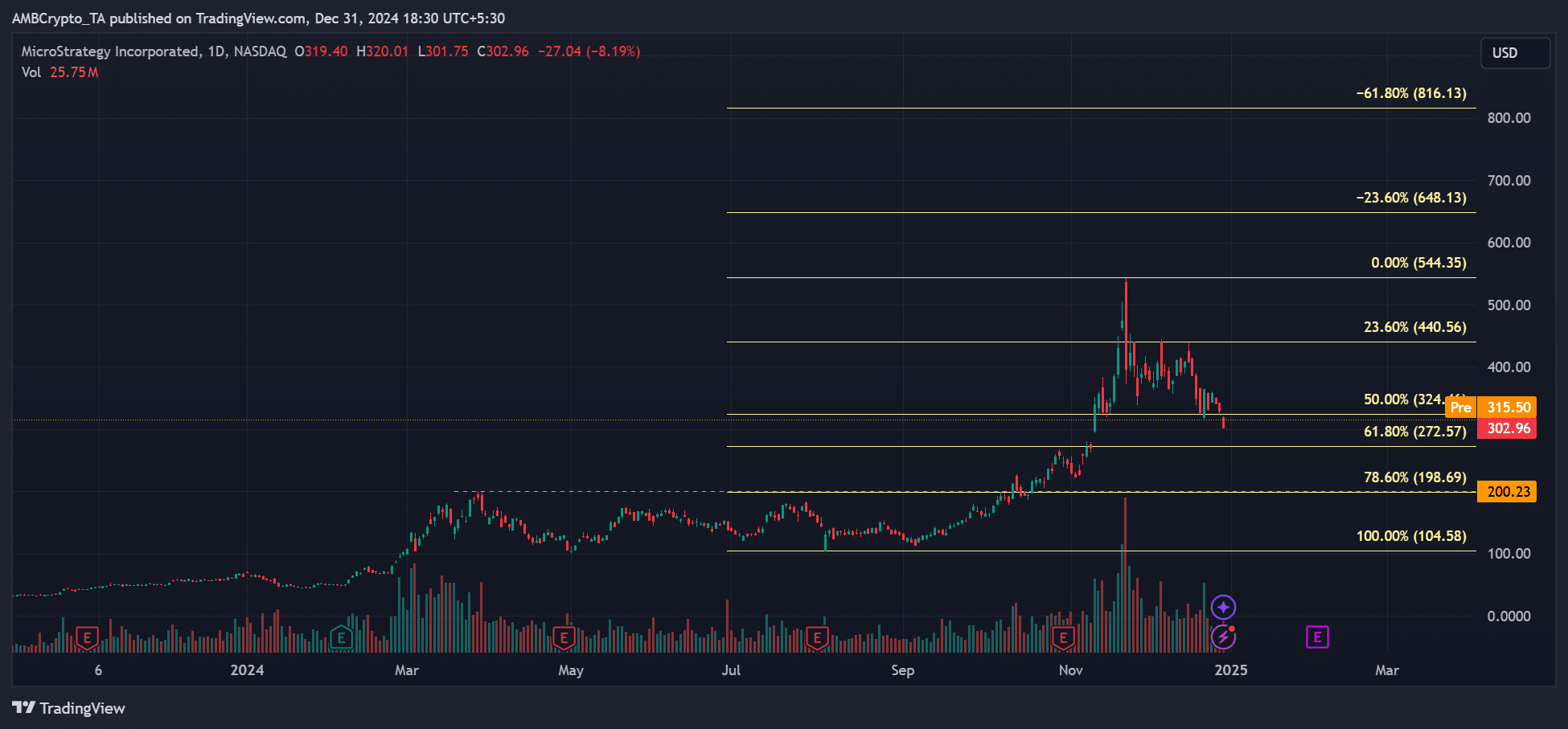

Within the meantime, MSTR was down 45% from its current peak of $543 and was defending $300 at press time. This adopted BTC’s sharp decline from $108K to $92K.

Any additional weakening may provide discounted shopping for alternatives for MSTR, particularly if the market recovers in January.

- MicroStrategy’s MSTR noticed 342% yearly features in comparison with BTC’s 122%.

- Nevertheless, ongoing BTC weakening may drag MSTR decrease in January.

MicroStrategy purchased one other 2,138 Bitcoins ($209 million) on the finish of the 12 months, bringing its general holdings to 446.4K cash, price over $41 billion.

The pioneer within the BTC company treasury now holds 2.12% of the whole BTC provide, and the first beneficiary has been MSTR shareholders.

On a YTD (year-to-date) foundation, MSTR logged 342% features, whereas BTC logged 122% over the identical interval.

That meant MSTR traders outperformed their BTC counterparts by practically 3x in 2024. Curiously, each property eclipsed gold and US shares (S&P 500) which tapped 26% and 24% yearly features, respectively.

So, what’s subsequent for BTC and MicroStrategy in 2025?

The agency plans to broaden its fairness issuance program to 10 billion MSTR shares to speed up its BTC shopping for spree. Most analysts imagine this might pump BTC’s worth.

In actual fact, Blockware projected that BTC may hit $225K or $400K in 2025 if BTC company treasury adoption accelerates alongside the creation of a US BTC strategic reserve.

Supply: Blockware

Nevertheless, in line with the Blockware staff, BTC may solely attain $150K in a ‘bear case’ state of affairs.

Nevertheless, QCP Capital predicted that BTC may stay muted into January, citing seasonality traits. If that’s the case, MSTR’s short-term features might be capped till the market recovers.

Within the meantime, MSTR was down 45% from its current peak of $543 and was defending $300 at press time. This adopted BTC’s sharp decline from $108K to $92K.

Any additional weakening may provide discounted shopping for alternatives for MSTR, particularly if the market recovers in January.