We’re excited to introduce a big replace to one in all our core merchandise – KYC (Know Your Customer)!

The most recent launch consists of new options to streamline the onboarding course of, providing companies extra flexibility in assembly regulatory necessities whereas bettering person expertise.

- Enhanced Stability & Improved Design: The person interface has been revamped, specializing in accessibility and ease of use. It’s extra dependable and scalable, making KYC a great resolution for dealing with giant verification requests with out impacting efficiency.

- Help for Extra Languages: KYC now helps 25+ languages, together with English, Chinese language, German, Spanish, Dutch, and French (amongst others), making it simpler for firms working globally to fulfill regional compliance necessities.

- Detailed Studies: Studies at the moment are extra complete, providing a deep dive into every verification step, from doc checks to video quiz outcomes, guaranteeing extra transparency and accuracy.

- Video Name Choices: Customers can now take part in reside video calls as a part of the verification course of. This characteristic provides an additional layer of safety by permitting brokers to work together instantly with candidates.

- Two-Issue Authentication (2FA): Our platform now helps 2FA for a better degree of safety, requiring customers to confirm their identification utilizing an authenticator app like Google Authenticator.

We have already coated the numerous enhancements within the up to date KYC. Now, let’s dive deeper into how the interface displays these updates.

Verification Steps

The verification course of now consists of a number of steps designed to make sure thorough identification checks. From fundamental Profile Info/Doc/ Tackle Verification to superior strategies like Liveness Detection, Tax ID, and Supply of Funds.

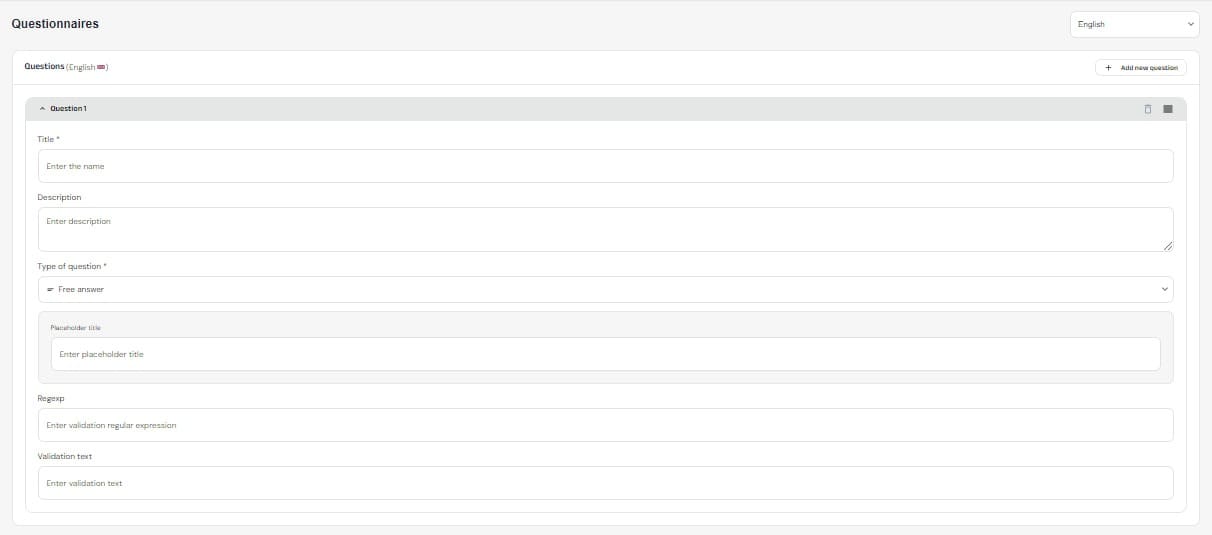

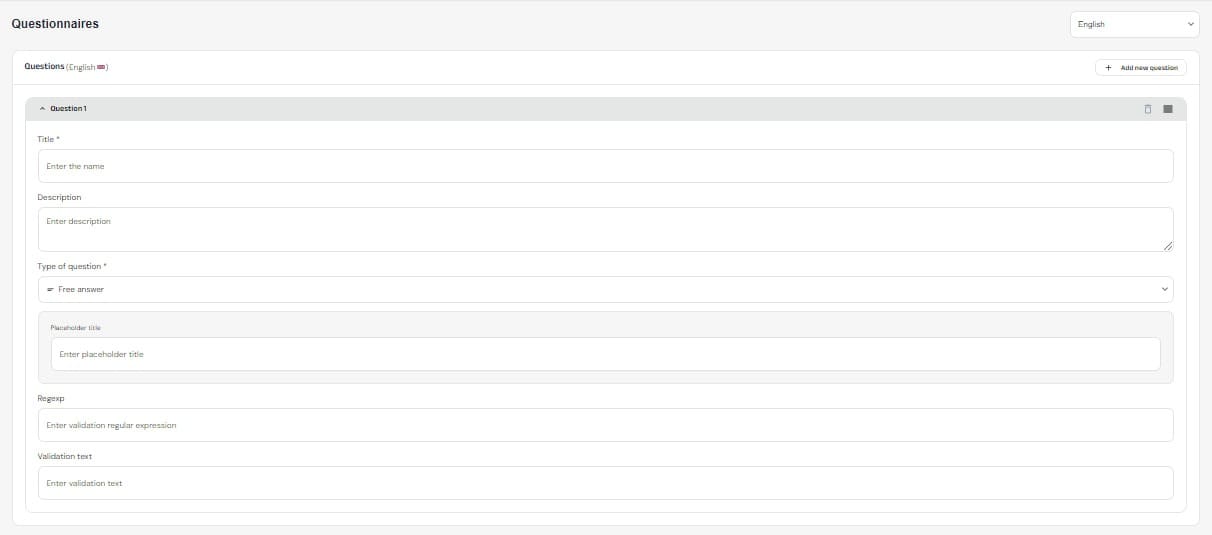

Along with commonplace checks, the brand new Video Quiz gives an interactive method to confirm customers’ identities via adjustable questions. The Reside Video possibility permits for real-time face-to-face verification. The brand new replace additionally introduces the Questionnaires, permitting companies to create customized verification questions for candidates.

Language Help Growth

Working globally? No drawback. The platform has expanded its supported languages to 25+ choices, together with English, Russian, Chinese language, German, Portuguese, and Kazakh, guaranteeing companies can simply function globally.

By providing an array of language choices, the platform helps firms to offer a seamless person expertise throughout completely different areas, guaranteeing that verification processes might be shortly accomplished within the person’s native language.

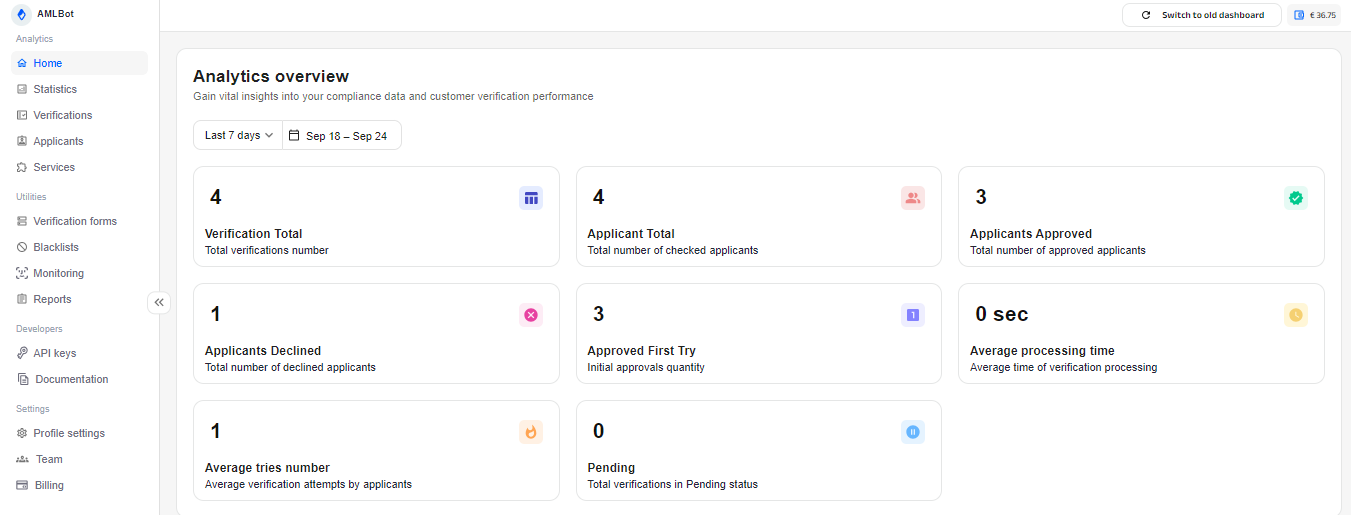

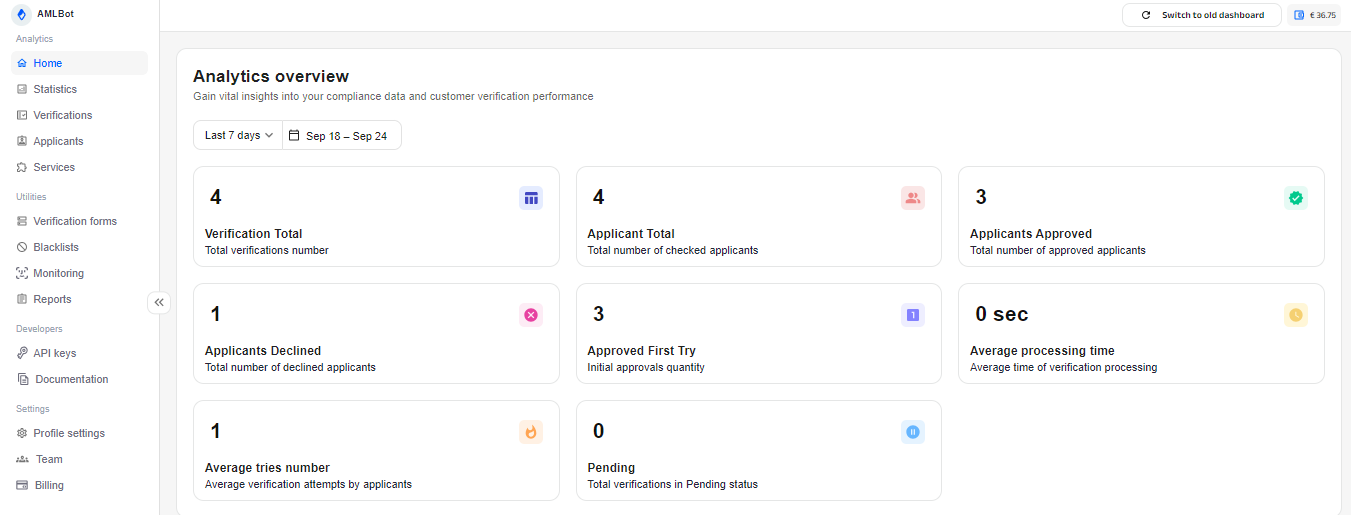

Analytics

This web page supplies a complete snapshot of KYC efficiency metrics, together with complete verifications, the variety of authorized or declined candidates, common processing time, pending verifications, and so forth. On the prime, customers can filter the candidates by interval and particular dates.

Studies

This part now provides customers a high-level line graph view of Verifications and Candidates over a specific time vary. The overview consists of two most important graphs, every representing developments and fast insights into efficiency within the verification course of:

1. Verifications Graph

- Complete (Blue Line 🔵): The variety of verifications processed per day.

- Authorized (Inexperienced Line 🟢): The variety of verifications that have been authorized.

- Declined (Purple Line 🔴): The variety of verifications that have been declined.

2. Candidates Graph

- Complete (Blue Line 🔵): The full variety of candidates present process the verification course of every day.

- Authorized (Inexperienced Line 🟢): The variety of authorized candidates.

- Declined (Purple Line 🔴): The variety of candidates who have been declined.

By evaluating the charges throughout each verifications and candidates, companies can assess the effectiveness of their KYC course of and make changes the place wanted. It permits them to make data-driven selections shortly and be sure that their verification course of is working easily.

Quantity of Verifications

The graph summarizes verification developments over the required time vary. It helps to trace and analyze how the verification course of is performing each day.

- Complete (Blue Line 🔵) –The Complete Quantity Processed Every Day.

- Authorized (Inexperienced Line 🟢) – Authorized Verifications.

- Declined (Purple Line 🔴) – Declined Verifications.

This graph supplies a easy and intuitive method to monitor developments in verification exercise. Customers can shortly determine days when verification exercise spikes or declines and see what number of verifications are authorized or declined over time.

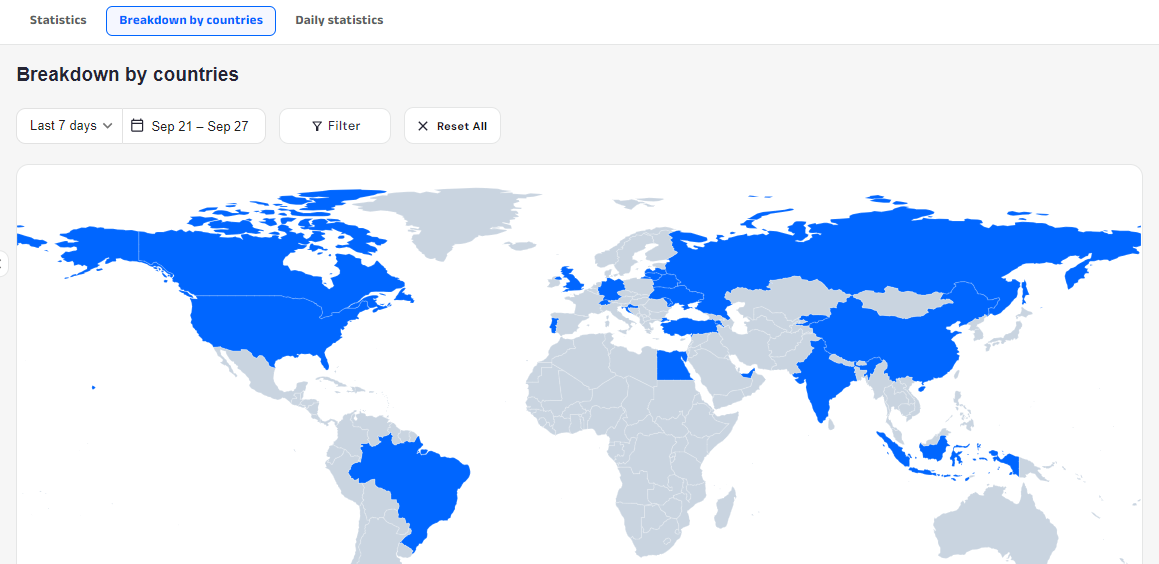

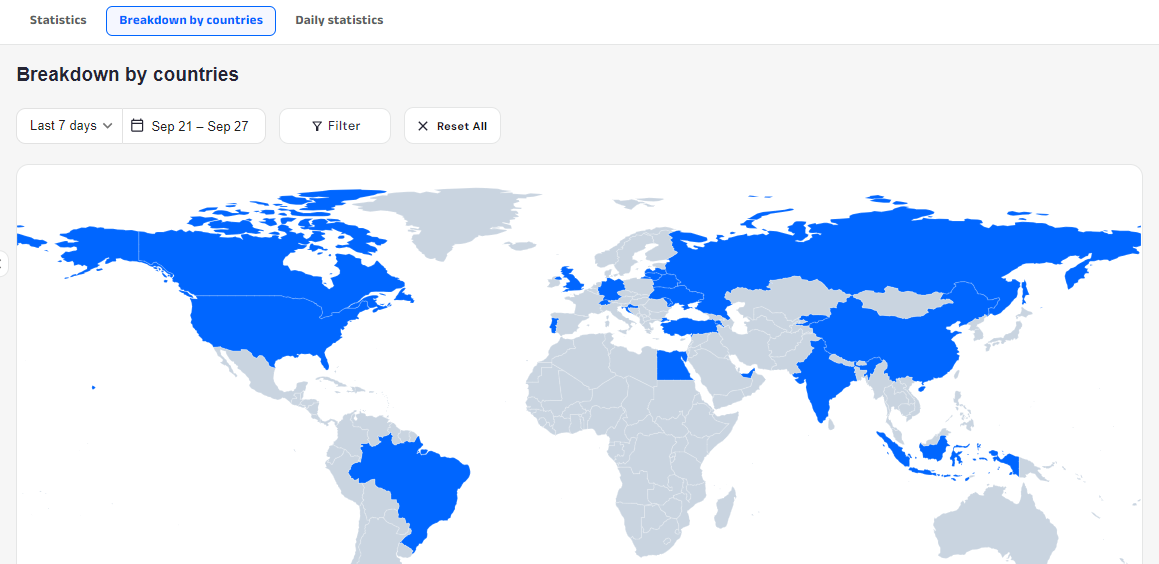

Breakdown by Nations

This part supplies a geographical illustration of the place verifications are carried out. The information is introduced on a world map, with nations which have carried out verifications highlighted in blue. It gives priceless insights into the place customers are coming from, which may help firms alter their onboarding processes or allocate sources extra successfully in key areas.

Day by day Statistics

This part gives an in depth breakdown of day by day key verification metrics. It consists of the full variety of verifications accomplished every day, the quantity and share of verifications authorized or declined, the common variety of makes an attempt candidates made to finish the verification, the automated checks share, and so forth. Customers may also create an in depth report back to obtain the displayed information for record-keeping or additional evaluation. That is notably helpful for producing studies that may be shared with compliance groups or utilized in audits.

Verifications

On this part, customers can monitor and handle accomplished verifications. On the prime, customers can filter verifications primarily based on time and use the search bar, the place customers can enter a Verification ID to seek out particular verification information. This makes it simple to trace down particular person verifications for evaluation. Moreover, sorting choices enable organizing verifications by varied standards, such because the date they have been accomplished.

We’re excited to introduce a big replace to one in all our core merchandise – KYC (Know Your Customer)!

The most recent launch consists of new options to streamline the onboarding course of, providing companies extra flexibility in assembly regulatory necessities whereas bettering person expertise.

- Enhanced Stability & Improved Design: The person interface has been revamped, specializing in accessibility and ease of use. It’s extra dependable and scalable, making KYC a great resolution for dealing with giant verification requests with out impacting efficiency.

- Help for Extra Languages: KYC now helps 25+ languages, together with English, Chinese language, German, Spanish, Dutch, and French (amongst others), making it simpler for firms working globally to fulfill regional compliance necessities.

- Detailed Studies: Studies at the moment are extra complete, providing a deep dive into every verification step, from doc checks to video quiz outcomes, guaranteeing extra transparency and accuracy.

- Video Name Choices: Customers can now take part in reside video calls as a part of the verification course of. This characteristic provides an additional layer of safety by permitting brokers to work together instantly with candidates.

- Two-Issue Authentication (2FA): Our platform now helps 2FA for a better degree of safety, requiring customers to confirm their identification utilizing an authenticator app like Google Authenticator.

We have already coated the numerous enhancements within the up to date KYC. Now, let’s dive deeper into how the interface displays these updates.

Verification Steps

The verification course of now consists of a number of steps designed to make sure thorough identification checks. From fundamental Profile Info/Doc/ Tackle Verification to superior strategies like Liveness Detection, Tax ID, and Supply of Funds.

Along with commonplace checks, the brand new Video Quiz gives an interactive method to confirm customers’ identities via adjustable questions. The Reside Video possibility permits for real-time face-to-face verification. The brand new replace additionally introduces the Questionnaires, permitting companies to create customized verification questions for candidates.

Language Help Growth

Working globally? No drawback. The platform has expanded its supported languages to 25+ choices, together with English, Russian, Chinese language, German, Portuguese, and Kazakh, guaranteeing companies can simply function globally.

By providing an array of language choices, the platform helps firms to offer a seamless person expertise throughout completely different areas, guaranteeing that verification processes might be shortly accomplished within the person’s native language.

Analytics

This web page supplies a complete snapshot of KYC efficiency metrics, together with complete verifications, the variety of authorized or declined candidates, common processing time, pending verifications, and so forth. On the prime, customers can filter the candidates by interval and particular dates.

Studies

This part now provides customers a high-level line graph view of Verifications and Candidates over a specific time vary. The overview consists of two most important graphs, every representing developments and fast insights into efficiency within the verification course of:

1. Verifications Graph

- Complete (Blue Line 🔵): The variety of verifications processed per day.

- Authorized (Inexperienced Line 🟢): The variety of verifications that have been authorized.

- Declined (Purple Line 🔴): The variety of verifications that have been declined.

2. Candidates Graph

- Complete (Blue Line 🔵): The full variety of candidates present process the verification course of every day.

- Authorized (Inexperienced Line 🟢): The variety of authorized candidates.

- Declined (Purple Line 🔴): The variety of candidates who have been declined.

By evaluating the charges throughout each verifications and candidates, companies can assess the effectiveness of their KYC course of and make changes the place wanted. It permits them to make data-driven selections shortly and be sure that their verification course of is working easily.

Quantity of Verifications

The graph summarizes verification developments over the required time vary. It helps to trace and analyze how the verification course of is performing each day.

- Complete (Blue Line 🔵) –The Complete Quantity Processed Every Day.

- Authorized (Inexperienced Line 🟢) – Authorized Verifications.

- Declined (Purple Line 🔴) – Declined Verifications.

This graph supplies a easy and intuitive method to monitor developments in verification exercise. Customers can shortly determine days when verification exercise spikes or declines and see what number of verifications are authorized or declined over time.

Breakdown by Nations

This part supplies a geographical illustration of the place verifications are carried out. The information is introduced on a world map, with nations which have carried out verifications highlighted in blue. It gives priceless insights into the place customers are coming from, which may help firms alter their onboarding processes or allocate sources extra successfully in key areas.

Day by day Statistics

This part gives an in depth breakdown of day by day key verification metrics. It consists of the full variety of verifications accomplished every day, the quantity and share of verifications authorized or declined, the common variety of makes an attempt candidates made to finish the verification, the automated checks share, and so forth. Customers may also create an in depth report back to obtain the displayed information for record-keeping or additional evaluation. That is notably helpful for producing studies that may be shared with compliance groups or utilized in audits.

Verifications

On this part, customers can monitor and handle accomplished verifications. On the prime, customers can filter verifications primarily based on time and use the search bar, the place customers can enter a Verification ID to seek out particular verification information. This makes it simple to trace down particular person verifications for evaluation. Moreover, sorting choices enable organizing verifications by varied standards, such because the date they have been accomplished.